Emboldened by dramatic monetary and fiscal stimulus, global equities rebounded strongly in the second quarter on hopes of a V-shaped economic recovery. Despite lingering economic worries, the S&P 500’s 20.1% surge was the biggest quarterly gain since 1998, while MSCI Emerging Markets’ 18.1% jump was its largest since 2009. However, neither fully recovered its prior quarter’s loss. Within equity markets, growth continued its romp over value, led by mega-cap technology stocks benefiting from a shelter-in-place world. The extraordinary policy measures to backstop economies also solidified the bid for credit, particularly among marginal investment grade bonds, as evidenced by the Bloomberg Barclays US BBB Corporate Bond Index’s 11.5% leap.

As a safe-haven asset, Treasuries were flat in this risk-on setting. However, spot gold prices swelled again along with TIPS, as real yields became negative with inflation concerns replacing deflation worries of the first quarter. After losing 23.5% in the prior quarter, the Bloomberg Commodity Index recovered 5.0%, with the U.S. dollar modestly weakening.

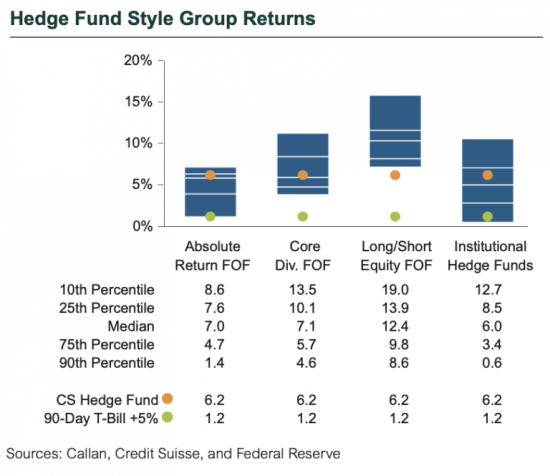

As markets reverted to a full risk-on mode, most hedge fund strategies benefited. The Credit Suisse Hedge Fund Index (CS HFI), a benchmark for direct hedge fund performance without implementation costs, rose 6.2% in the second quarter, its strongest quarterly performance since 2009. However, it was still down 3.3% year to date. The median manager in the Callan Hedge Fund-of-Funds Database Group, a proxy for hedge FOFs, advanced 7.7% net of all fees and expenses. For the first half, the median was modestly down 1.2%.

The median manager in the Callan Institutional Hedge Fund Peer Group, tracking 50 of the largest, broadly diversified hedge funds with low-beta exposure to equity markets, advanced 6.0% and recaptured almost all of its prior quarter loss. Those funds focused on market neutral equity or rates arbitrage edged ahead 3% to 5%, yielding a roughly 3% year-to-date gain. Those more exposed to illiquid credit strategies rebounded over 7%, but still with single-digit losses year to date. Funds with multiple or cross-asset hedging strategies performed in line with the broad group’s average.

Within Callan’s Hedge FOF Group, market exposures notably affected performance in the second quarter. Given its net long equity exposure, the Callan Long/Short Equity FOF (+12.4%) decidedly beat the Callan Absolute Return FOF (+7.0%). With diversifying exposures to both non-directional and directional styles, often including macro strategies, the Core Diversified FOF added 7.1%.

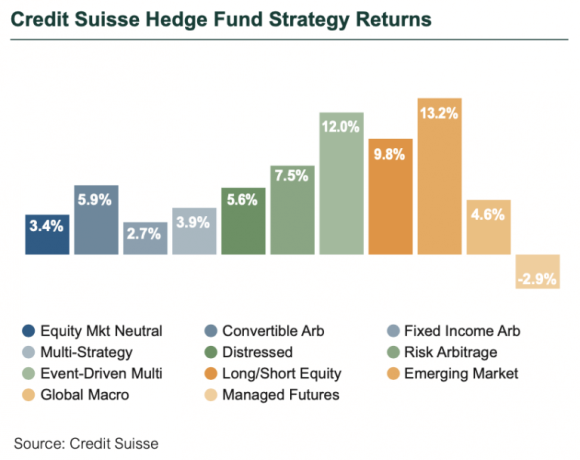

Within CS HFI, the best-performing strategy last quarter was Emerging Markets (+13.2%), regaining more than its 10.5% loss in the prior quarter. Event-Driven Multi-Strategy rebounded 12.0%, leaving it down 9.0% year to date, with its often soft-deal exposures remaining less than sure bets. As bottom-up stock pickers with a roughly 0.5 beta exposure to equity markets, Long/Short Equity appreciated 9.8%. Beyond the direct reach of economic stimulus, Distressed (+5.6%) clawed back only half of its first quarter loss.

Arbitrage strategies also benefited from the risk-on rally, but their hedges limited gains to mid-single digits or less. Bright spots were Risk Arb (+7.5%) and Convertible Arb (+5.9%), as strong equity markets supported existing mergers and timely convertible issuance, thereby enabling these strategies to finish the first half with modestly positive returns.

As the worst-performing strategy in the CS HFI, Managed Futures (-2.9%) was caught flat-footed in the sudden equity rally and lost ground, particularly with trend-following strategies, after also lacking traction in the first quarter.

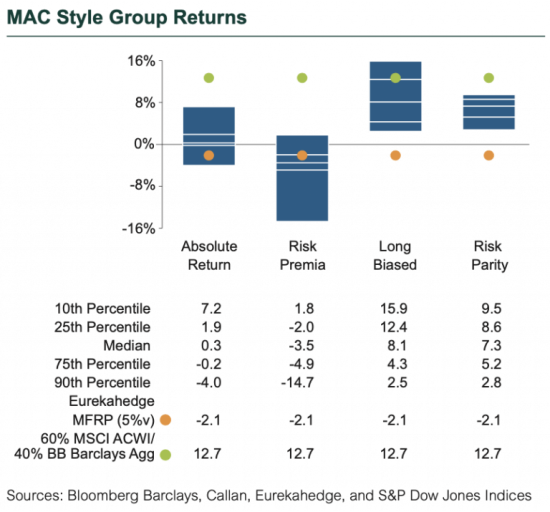

Since the Global Financial Crisis, liquid alternatives to hedge funds have been popular among institutional investors for their attractive risk-adjusted returns that are also less correlated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate alternative risk premia found across the capital markets. These premia are often embedded in hedge funds and other actively managed investment products. Providing a combined measure of these alternative beta risk factors, the Eurekahedge Multi-Factor Risk Premia Index lost 2.4% based upon a 5% volatility target. For the quarter, the equity value factor was again a material detractor while other factors like carry and momentum were mixed performers across asset classes.

Within Callan’s database of liquid alternative solutions, the median managers of Callan Multi-Asset Class (MAC) Style Groups generated mixed returns, gross of fees, consistent with their underlying risk exposures. Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC added 7.3%. However, the more traditional equity-centric benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index rose 12.7%. Given a usually long equity bias within dynamic asset allocation models, the Callan Long-Biased MAC (+8.1%) also trailed the static global benchmark. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC edged ahead 0.3%. Reflecting the second quarter’s challenging environment for alternative betas, as noted above, the median Callan Risk Premia MAC fell 3.5%.

Given the economic uncertainty ahead, the outlook for hedge funds and alternative betas remains ripe with more “alpha” potential. Coupled with diverging paths of economies around the globe, the likely greater-than-average volatility ahead for capital markets creates both fundamental and tactical opportunities for risk allocators embodied in hedge funds and other liquid alternatives. In such a market setting, strategies of macro, relative value, and event-driven trades are well positioned to play a diversifying role for the traditional long-only investor facing subdued return potential from both stocks and bonds.