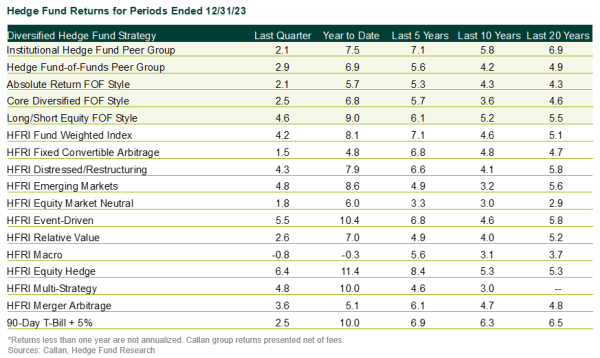

Hedge funds finished off 2023 on a strong note with the HFRI Fund Weighted Composite ending 8.1% higher and the Callan Institutional Hedge Fund Peer Group, a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, gaining 7.5%. Markets rallied into year-end on expectations that the Federal Reserve was done raising interest rates during this market cycle and will soon begin the easing process.

Hedge funds entered 2023 very defensive on concerns about rising inflation, the possibility of a recession, and worries the Fed would continue to aggressively raise interest rates. Following the banking crisis in March, hedge funds started to increase their risk as equity markets soared on the back of large capitalization technology stocks. Within credit, spreads tightened throughout the year despite some distressed opportunities popping up. Overall, the markets have assumed the Fed has accomplished its mission of taming inflation, despite no labor market weakness in its official data.

2024 Hedge Fund Outlook

As we turn our attention to 2024, the market environment should provide hedge funds with many investing opportunities. Managers will have to navigate macroeconomic, geopolitical, and fundamental cross-currents; those that are able to adapt effectively to these shifts will succeed throughout the year. Callan continues to believe this elevated short-term rate environment should increase the expected return for hedge fund strategies. The longer that short-term rates remain high, we believe market volatility will also remain elevated and provide hedge fund strategies more compelling opportunities.

Equity hedge strategies | 2023 Return: +11.4%

Equity hedge strategies (28% of hedge fund assets under management (AUM), according to HFR) gained as market volatility remained relatively muted except for short spurts of volatility around the March banking crisis. Equity markets were driven by the Magnificent Seven stocks, which include Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta Platforms, all of which bounced back after a disappointing 2022.

Overall, equity hedge managers with a focus on TMT (tech, media, and telecom) drove overall performance during the year. Equity hedge strategies with higher net long exposure tended to perform better than those that remained defensive throughout the year. Given a soaring market in 2023, shorting single name equities was challenging for many managers. Those that found success were actively shorting names across the financial, real estate, and consumer discretionary sectors.

Within equity hedge strategies, Callan believes that managers with a successful track record of investing both on the long and short side should be well situated to profit in 2024. Callan is recommending clients focus on equity hedge managers that run with net exposure in the range of 30%-50% and bypass managers that run more long-biased, which can lead to larger drawdowns. Over the past five to seven years, many equity hedge managers have thrown in the towel on shorting individual companies; those that have stuck to their knitting should be able to generate alpha given the higher dispersion across sectors in this current market environment. Given the elevated interest rate environment, managers that are shorting individual securities will continue to receive higher rebates on collateral posted for short positions.

Event-driven strategies | 2023 Return: +10.4%

Event-driven strategies (27% of AUM) rose as managers were able to take advantage of the volatility of interest rates, along with special-situation equities throughout the year. Within credit, the 10-year U.S. Treasury yield peaked in October around 5% and retraced all the way to 3.9%, which is where it started 2023. This move in rates allowed credit investors to avoid another year of losses in fixed income. High yield spreads tightened throughout the year, allowing the market to post a double-digit gain for the year. Within event-driven equities, managers found profitable positions in travel and entertainment, as well as some opportunistic investments made in the financial sector following the banking crisis in March.

Event-driven strategies have seen two years of slow to nonexistent corporate dealmaking, dampened by rising interest rates. As financing costs soared, it was nearly impossible for market participants to find buyers for transactions. Callan suspects there is a buildup of prospective transactions by venture capital and private equity holders that must move their portfolio companies toward an IPO or acquisition. This bodes well for event managers that are active in this equity part of the market.

Within event-driven credit, we suspect that opportunity will present itself for some leveraged borrowers that are currently dealing with higher interest expense and must soon refinance at a higher interest rate. This should provide more opportunities for managers to go both long and short event-driven credit where they see alpha opportunities.

Relative Value Strategies | 2023 Return: +7.0%

Relative value strategies (27% of AUM) saw higher returns as managers were able to successfully profit off the volatility across different credit instruments. Convertible bond strategies had a profitable year, as they benefited from traditional volatility trading and took advantage of an increase in convertible bond new issuance throughout the year. Within reinsurance, the industry saw substantial price increases in 2023, as managers were able to clip high premiums without experiencing any major loss events during the year.

When looking at relative value strategies, Callan continues to like the uncorrelated nature and attractive yields of the reinsurance space. The 2023 hurricane season came to an end with a total of 20 named storms, of which three were considered major hurricanes (Category 3 or above). There was a relatively high percentage of the 2023 insured losses that were retained by insurance companies, so there was limited impact to reinsurers. Most insurers, reinsurers, and market observers are expecting a continuation of a “hard market,” generally defined as when the price per unit-of-risk is elevated and profit margin potentials are higher than in recent periods compared to historical trends and averages.

Macro Strategies | 2023 Return: -0.3%

Macro strategies (17% of AUM) fell as commodity positioning offset the positive attribution that some managers saw in rates trading. Going into March, discretionary macro managers were positioned short duration in the U.S. on the view that inflation would remain sticky and that the Fed would need to continue hiking rates for longer than the market expected. This was a popular position across discretionary macro; when the government was forced to surprisingly support banks in mid-March, there was a rush by these managers to get out of the position all at the same time. Managers started to recover from this drawdown by profiting from global rates trading, which involved positioning for higher rates for longer than expected. Commodity positioning in long energies and agricultural commodities offset some of the positive rates trading coming out of the first quarter.

Callan expects macro performance to be volatile throughout 2024, as there is increased geopolitical risk coupled with a U.S. presidential election. Interest rate policy not only in the U.S. but across Europe and Asia will be a focus for managers in 2024. Managers are attempting to position themselves to profit when the rate cutting begins and by predicting how many cuts there will be. Given this perceived increase in market volatility, it should allow managers to express a diverse range of views both long and short across global interest rates, currencies, commodities, and equities. As short-term rates remain elevated, this will allow macro managers that invest on margin to earn higher interest on their unencumbered cash.

The Year Ahead

Overall, Callan remains constructive on hedge funds in 2024. Hedge funds can provide institutional portfolios with diversification that is not found elsewhere in their portfolio. Managers have the ability to go both long and short multiple asset classes throughout different market cycles. For institutional investors that are looking to review, expand, or add a hedge fund allocation to their portfolio, we recommend the following key questions before investing:

- Does the hedge fund manager have a track record of investing over different market cycles?

- Have the key decision-makers been working together for quite some time, or have they recently been paired together?

- Is the investment strategy easy to understand and are you able to describe that strategy to your broader investment team/oversight committee? If you are not able to understand the strategy and articulate what the manager does to others in the organization, it’s probably not the right investment for you.

- Understanding what the risk management process is within a hedge fund manager will help you better understand how it views risk in the portfolio. Is there a dedicated risk professional or is risk management handled by the chief investment officer, who is putting on the trades. Separation of the risk management function from the investing side of the business is highly valued when looking at managers.

- Do the returns generated from a particular strategy warrant paying higher fees? Callan evaluates that by conducting analysis on the alpha that is produced by strategies. This would warrant paying higher fees if the alpha was consistent over the life of the fund. (Typical fees range from 1%-2% management fees and 20% performance fee.)

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.