Our 2024 Asset Manager DEI Study is our first examination of how investment managers approach diversity, equity, and inclusion (DEI) in their own firms. In essence, the study provides a high-level assessment of the degree to which these organizations have established DEI policies and procedures.

Reflecting the input of over 1,200 unique organizations to DEI questions in Callan’s proprietary manager database, the 2024 DEI Study found a higher percentage of larger firms with policies and practices in place. This result is not surprising, given that larger organizations tend to have more resources to dedicate to these initiatives.

Key Findings of the 2024 DEI Study

This study helps us gauge how asset management firms incorporate DEI practices into their core business and is the baseline in our benchmarking as we analyze trends over time. Of the firms that responded to these questions:

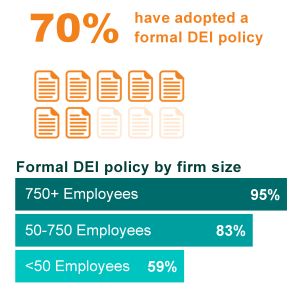

- 70% have adopted a formal DEI policy, which typically articulates an organization’s commitment to ensuring an equitable, diverse, and inclusive workplace

- 71% have diverse recruitment initiatives, with legal restrictions around identifying individual demographics possibly a reason for Canada and other countries being farther behind the U.S. and U.K.

- 65% have a DEI training program, which is more typical at larger firms with greater resources

- 50% have mentorship programs for underrepresented groups, showing that firms with a higher headcount have more employees willing to dedicate time to them

- 37% have a pay-parity policy, which appears to be one of the more challenging policies to implement across the industry

Demographics and DEI Score

The study analyzes responses to various DEI questions in Callan’s manager database by firm size, asset class, country of domicile, and ownership structure.

Mirroring trends seen across the broader institutional investment landscape, our collected responses show that firms with assets under management (AUM) below $10 billion constitute many of the respondents, accounting for 63% of the total. Additionally, firms managing between $10 billion and $50 billion in assets represent 20% of respondents, while those overseeing more than $50 billion comprise the remaining 17%.

Callan’s proprietary DEI score, which ranges from 0 to 3, is a high-level assessment of the degree to which an investment manager adheres to “best practices” as they pertain to DEI. Importantly, the DEI score also includes employee and ownership demographics. The median DEI score was 2.03, with the largest firms by either AUM or number of employees trending higher.

A Rich History of Tracking and Advancing DEI

Callan has been tracking this type of data in our proprietary database for decades, starting with gender in the 1970s. We expanded our efforts to include ethnicity beginning in the mid-1980s and additional demographics in the 2020s, such as the DEI data included in this study. We also launched Callan Connects in 2010 to engage emerging managers and diverse-, women-, and disabled-owned (DWDO) firms—the first investment consultant to do so.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.