Private credit performance varies across sub-asset class and underlying return drivers but has generally delivered IRRs in the 8%-10% range over the long term. Institutional investor interest in the asset class remains strong.

Key trends in private credit

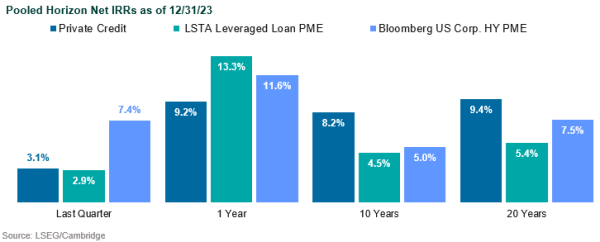

- In 4Q23, it gained 3.1%, slightly above a leveraged loan index and well below a high yield benchmark.

- Over the past 10 years, the asset class has generated a net IRR of 8.2%, outperforming leveraged loans and high yield bonds, as of Dec. 31, 2023.

- Higher-risk strategies have performed better than lower-risk strategies.

- Private credit remained in high demand across Callan’s investor base, and a number of large defined benefit plans are looking to increase their existing private credit allocations from 2%–3% to 5%–10%.

- While we always work to build out diversified client portfolios, we think there is particularly interesting relative value in middle market direct lending with an emphasis on unique capital solutions. We also view asset-based lending as an attractive opportunity set.

- We are seeing an uptick in stress for some individual names in direct lending portfolios due to a combination of input cost inflation and increased interest expense.

- Private credit AUM stood at over $1.5 trillion at the end of 2023, with Preqin forecasting the asset class will grow to over $2.5 trillion by 2028 at a 11.13% CAGR from 2023 to 2028.

- Direct lending is expected to grow steadily through 2028 as investors increase their private credit allocations.

- Distressed exposure will grow a bit more slowly, with other strategies such as opportunistic, special situations, and other niche diversifiers growing more quickly.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.