Listen to This Blog Post

Private credit gained 1.8% in 2Q24. Fundraising, by number of funds, is off historical levels but capital raised is in line with the last few years. Interest in the asset class by institutional investors has stayed strong, especially by public DB plans.

Key trends in private credit

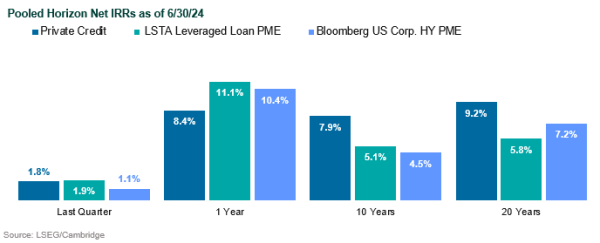

- Private credit gained 1.8% in 2Q24, the most recent quarter available, roughly even with a leveraged loan index and above a high yield index. Over longer time periods it has handily outperformed both indices. Fundraising, by number of funds, is off historical levels but capital raised is in line with the last few years. Interest in the asset class by institutional investors has stayed strong.

- Private credit performance varies across sub-asset class and underlying return drivers. Over the past 10 years the asset class has generated a net IRR of 7.9% as of 2Q24, outperforming leveraged loans. Higher-risk strategies have performed better than lower-risk strategies.

- The number of funds closed in 2Q24 was the lowest we’ve seen in years; however, aggregate capital raised is in line with the last few years and outpaced historical quarters.

- While direct lending continues to dominate fundraises, we are noticing increased interest in specialty finance strategies for more mature PC portfolios.

- Private credit stayed in high demand among Callan clients, and a number of large DB plans are looking to increase their allocations from 2%–3% to 5%–10%.

- Private credit AUM stood at over $1.5 trillion at the end of 2023, with Preqin forecasting the asset class could grow to over $2.5 trillion by 2028. Private credit AUM growth is expected to remain steady across geographies. While CAGR grew at about 17.5% from 2016 to 2022, CAGR is forecasted at 11.1% from 2024 to 2028.

- About 90% of investors expect either to maintain or increase their allocation in the next year.

- Direct lending is expected to grow steadily through 2028 as investors increase their private credit allocations. Distressed exposure should grow a bit more slowly with other strategies such as specialty finance and other niche diversifiers growing more quickly.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.