Listen to This Blog Post

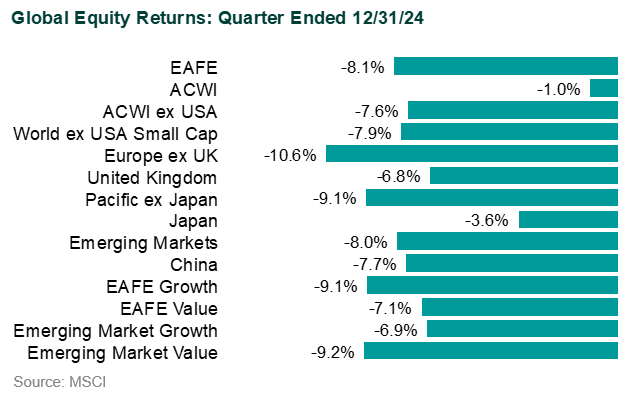

U.S. equities delivered modest gains in 4Q24 but capped off a second consecutive year of strong annual performance. Developed non-U.S. and emerging market equities underperformed U.S. equities in 4Q as a stronger U.S. dollar and concerns over slower global growth were headwinds. The greenback strengthened against most major currencies, with the euro (-7.2%), yen (-9.0%), and pound (-6.6%) all depreciating.

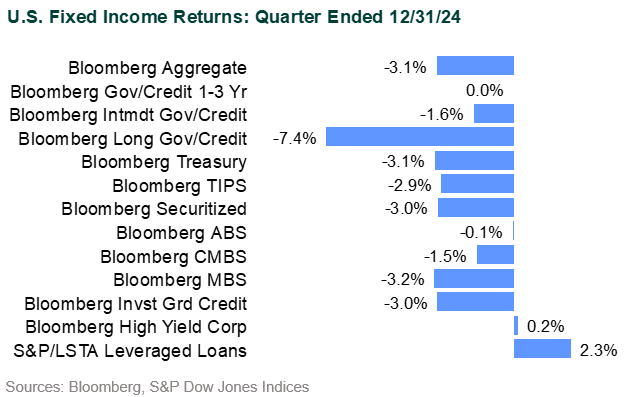

The U.S. bond market faced challenges across most sectors in 4Q but closed out the year primarily positive. Non-U.S. fixed income returns varied greatly depending on currency exposure.

How Global Markets in 4Q24 Did

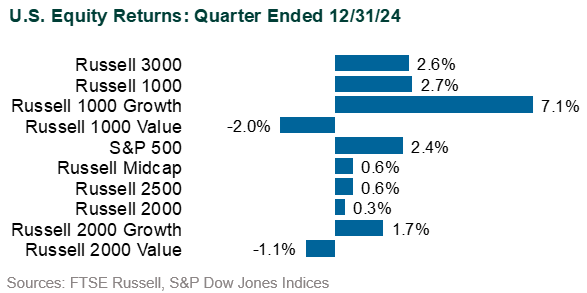

U.S. Equities: The S&P 500 Index rose 2.4% in 4Q, bringing its one-year return to an impressive 25.0%. The mega-cap “Magnificent Seven” drove equity market strength in 2024, most notably from Nvidia and Tesla, which were up 171.2% and 62.5% YTD, respectively. Sector dispersion remained a dominant theme during the quarter. Growth-oriented sectors stood out, particularly Consumer Discretionary (+14.3%) and Communication Services (+8.9%), supported by strong consumer demand. Technology (+4.8%) also posted solid gains and finished the year as the top-performing sector (+36.6%) fueled by the enthusiasm around AI. In contrast, defensive sectors struggled during the quarter. Real Estate (-7.9%), Utilities (-5.5%), and Consumer Staples (-3.2%) faced headwinds of rising interest rates and moderating inflation expectations.

Growth and value diverged further, reflecting investor preference for growth stocks, particularly in Technology. The Russell 1000 Growth Index outperformed with a quarterly return of 7.1%, while the Russell 1000 Value Index declined by 2.0%. Small cap stocks, as measured by the Russell 2000, were flat (+0.3%) during the quarter, with growth (+1.7%) outperforming value (-1.1%).

Global Equities: The MSCI ACWI ex-USA Index fell 7.6% in 4Q and ended the year with a gain of 5.5%. In developed markets, the MSCI EAFE Index declined 8.1% in 4Q, driven by broad weakness in Europe and the Pacific. Denmark (-21.5%) and Germany (-10.5%) were key detractors.

Emerging markets similarly struggled, with the MSCI Emerging Markets Index declining 8.0% during the quarter. Taiwan (+3.3%) was the standout performer, fueled by Technology. South Korea sank (-19.2%) as the country endured political upheaval with President Yoon Suk Yeol being impeached and his allies ousted after declaring martial law. Latin America faced significant challenges as Brazil (-19.4%) and Mexico (-10.6%) fell sharply due to currency depreciation and political uncertainty.

U.S. Fixed Income: U.S. Treasury yields soared, and the yield curve (2s/10s) experienced a notable steepening in 4Q. The 10-year yield increased from 3.8% to 4.6% and the 2-year yield rose from 3.7% to 4.3% as investors priced in resilient economic data, persistent inflation concerns, and the anticipation of continued fiscal borrowing.

The Bloomberg US Aggregate Bond Index fell 3.1% but managed to eke out a modest 1.3% gain for the year. Corporates outperformed U.S. Treasuries with excess returns of 82 bps while agency-backed mortgages, facing headwinds from increased rate volatility, underperformed (-13 bps). High yield corporates outperformed investment grade (Bloomberg High Yield Index: +0.2%) and were up 8.2% for the year. High yield spreads ground tighter and continued to trade through historical averages. Leveraged loans generated better returns in 4Q (S&P/LSTA Leveraged Loan Index: +2.3%) despite an uptick in defaults, according to J.P. Morgan, and the sector was up 9.0% for the year.

Municipal bonds were negative for the quarter but outperformed taxable bonds (Bloomberg Municipal Bond Index: -1.2%) while annual performance was positive (+1.1%). Lower-quality municipal bonds were in line with investment grade (Bloomberg Muni High Yield Index: -1.1%) and were up 6.3% for the year. While new issuance was met with solid demand for most of the quarter, there were signs of headwinds in December as fund flows turned negative for the first time since June 2024.

Global Fixed Income: The U.S. dollar surged roughly 8% versus a basket of six trade-weighted developed market currencies (DXY). The Bloomberg Global Aggregate ex-US Index (Hedged) rose 0.7% in 4Q but the unhedged index fell 6.8%. Emerging market debt faced similar challenges, with the JPM GBI-EM Global Diversified Index plummeting 7.0% in 4Q, while hard-currency EM debt declined 1.9% as measured by the JPM EMBI Global Diversified Index.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.