Listen to This Blog Post

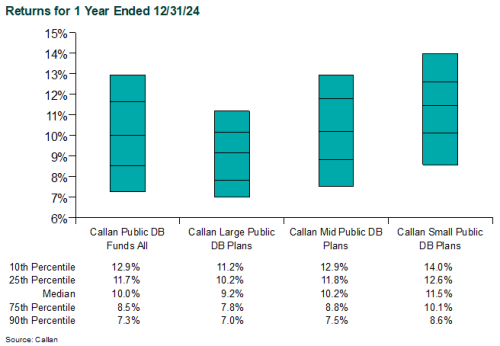

Dec. 31 is an important date for public defined benefit (DB) plans because it is a common plan fiscal year-end. In calendar year 2024, the median public DB plan gained 10.0%, well in excess of the average expected return of 7.25%. This marked the fifth time in six calendar years in which the median public pension plan’s return reached double digits. Most of the major asset classes ended the calendar year with gains, with U.S. equities (Russell 3000 Index) leading the pack with a jump of 23.8%. U.S. fixed income (Bloomberg US Aggregate Bond Index), the second-largest allocation among public plans, eked out a gain of 1.3%.

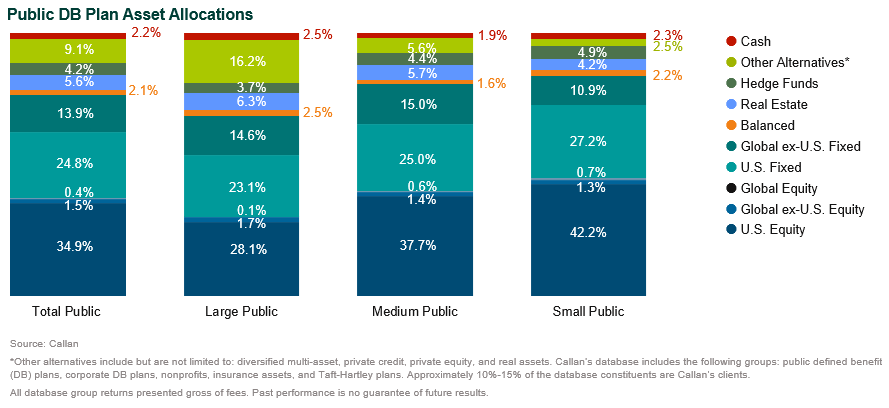

Dispersions in results by plan size once again were dictated by relative allocations to private market assets. The more liquid portfolios of small plans (<$100 million AUM) responded more quickly to the equity market rally, while private market portfolios were slower to aggressively update their marks. Private real estate (where larger plans have bigger average allocations) was once again the laggard asset class, with the NCREIF Property Index returning just 0.9% during the year.

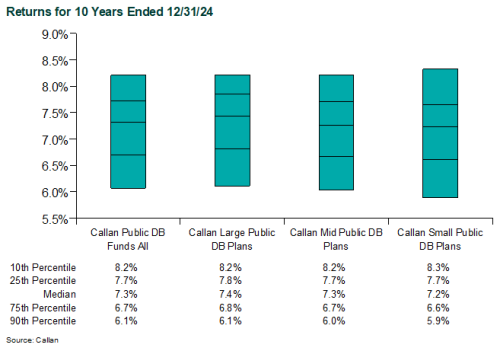

While near-term results have favored the more liquid, smaller plans, over longer time frames, the illiquidity premium of private market exposure has benefited larger plans. Over the 10-year timeframe, large plans (>$1bn) have marginally outperformed their small and mid-sized ($100mm-$1bn) peers.

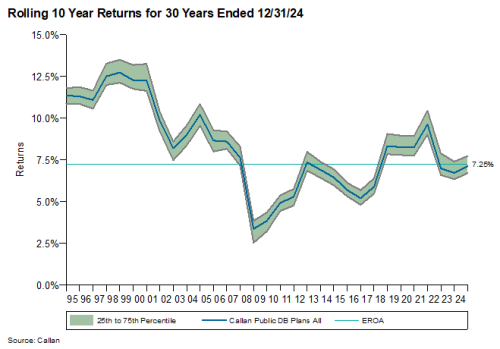

Larger plans have more capital to put to work and on average have higher allocations to private asset classes, which oftentimes have asset minimums or require greater scale to build a diversified portfolio. While many public plans are reconsidering the aggressiveness and complexity of their portfolios given more favorable return expectations in core fixed income, it remains to be seen whether that will translate into change. Many of the private market allocations have uncalled capital, which will continue to be drawn down into future years. Public plans also continue to have funding deficits that will need to be closed; this will in part have to be achieved by generating returns in excess of their estimated return on assets (EROA), which will require the continued use of private market assets where return expectations are higher.

While the larger plans may feel some admiration for their smaller peers’ superior performance, strategic decisions should emphasize long-term results, rather than react to any individual calendar year. The long-term approach has worked out over time as the median public plan’s 10-year return has exceeded a 7.25% return hurdle in 62% of quarters over the last 30 years. As always, Callan recommends public plans should focus on their ability to achieve their long-term EROA target rather than fixating on short-term volatility.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.