Plan sponsors who want to allow participants to contribute more Roth monies to a defined contribution (DC) plan than the standard limits have an option: The “Mega Roth,” an in-plan Roth conversion of after-tax contributions in the same year they are made to the DC plan.

These contributions work like this:

- Participants defer up to the limit set by Section 402g of the Internal Revenue Code ($18,500 in 2018) and receive any employer matching and/or non-elective contributions.

- Participants then contribute additional money up to the Section 415 limit ($55,000 in 2018) as an after-tax contribution.

- That money is then converted into a Roth in the same year the taxes were paid. (These are known colloquially as “mega Roth” contributions but we prefer “enhanced Roth contributions” to avoid images of Japanese monster movies!).

- A conversion can also be made outside of the plan if the participant is eligible for withdrawals or distributions, which involves moving money from the 401k plan into a Roth IRA.

The principal and earnings of any Roth amounts are not taxed for “qualified distributions” (i.e., the participant is older than 59½ and the amounts have been in the plan for at least five years). The earnings on any after-tax contributions not converted to a Roth are taxed when distributed from the plan.

This offers a number of opportunities for plan sponsors and participants:

- The limit on Roth deferrals in 2018 is $18,500 for a DC plan and $5,500 for an IRA. And that Roth IRA limit is even lower for employees with income greater than $189,000 filing jointly, or $120,000 filing as single. These enhanced Roth contributions allow employees to circumvent this limit and contribute significant additional amounts to the DC plan as a Roth contribution.

- This feature may be more attractive following the tax overhaul law passed in December 2017, reducing income tax rates for the next five years. Contributing amounts at a lower income tax rate, and recognizing that current law will raise tax rates in five years, allows participants to manage their tax risk.

- Participants may make in-plan Roth conversions at any time; however, if the conversion takes place in a later plan year, participants will need to pay income taxes on the earnings up to the time of conversion.

What sponsors and participants should keep in mind:

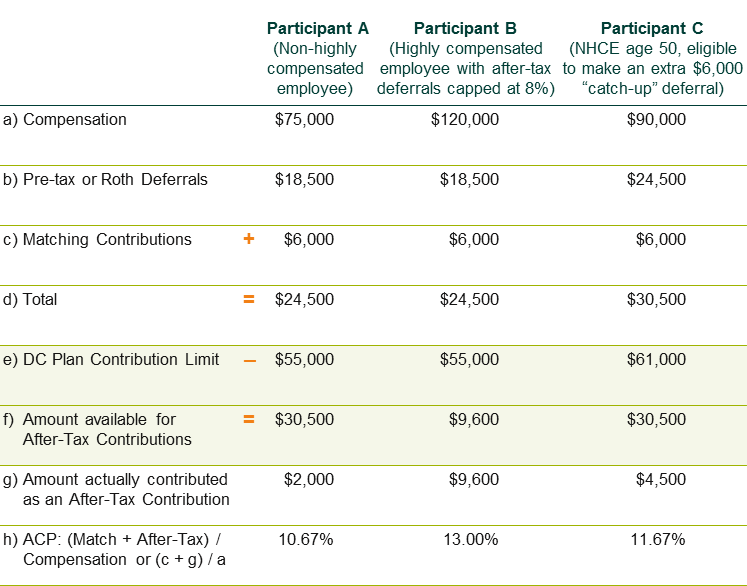

- After-tax contributions are subject to DC non-discrimination testing, and this can be an issue since the employees using this strategy tend to be higher paid. If the plan fails the Actual Contribution Percentage (ACP) test, then the excess amounts would need to be distributed from the plan in order to put the plan in compliance. Plan sponsors can minimize the impact on the ACP test by limiting contributions (see table below).

- ACP testing compares the average contribution rates of highly compensated employees against the average contribution rate for non-highly compensated employees. The test allows the HCE ratio to be the lesser of +2% or x2 of the NHCE ratio. For this purpose, after-tax contributions are part of the ACP test. A failed ACP test requires that the plan sponsor refund excess contributions to higher paid employees.

- After-tax contributions may have more liberal distribution rights (e.g., may be withdrawn at any time regardless of age or employment status) compared to pre-tax and Roth deferrals (i.e., withdrawal after age 59½ or termination from service).

- Each in-plan Roth conversion has a new five-year clock attached to it in order to be considered a “qualified distribution.” If you were to convert after-tax money on Dec. 31, 2017, the clock would expire Dec. 31, 2022, and any distributions of those monies after that date would be considered a qualified distribution. But if you were to convert money on Dec. 31, 2018, that money would have a new five-year clock, expiring in 2023.

- Regular Roth deferrals’ five-year clock starts on the date the first deferrals were made and the clock remains constant for all subsequent deferrals.

This plan feature requires participant action. Educating and communicating this option to employees may be challenging.

In the example above, the average NHCE ACP is 11.17%, while the average HCE ACP is 13.00%. A plan meets IRS rules if the ACP for eligible HCEs does not exceed the greater of:

- 125% of the ACP for NHCEs, or

- The lesser of:

- 200% of the NHCEs’ ACP

- ACP of the NHCEs + 2%

In this case, the passing threshold would be 13.96% and the plan passes.

Next steps for sponsors:

- Review nondiscrimination test results to determine any potential cap on after-tax contributions for HCEs.

- Plan sponsors should request a summary of their vendor’s capabilities, including administration, communication, and tax reporting. Additionally, the plan sponsor may want to solicit the vendor’s actual experience with this strategy and the adoption rate for plans that have implemented it.

- If the plan decides to go forward with adding this feature, we recommend the following steps:

- Amend the plan document.

- The Summary Plan Description should be modified or a Summary of Material Modifications issued to address the plan provision.

- Check with the recordkeeper on the timing to implement the provision.

- Work with the vendor to update the Plan Administration Manual.

- Adjust the payroll feeds to include the after-tax deferral election.

- Communicate to employees about the new feature and issue reminders as needed throughout the year.

- Ask the recordkeeper to conduct a mid-year projected test to confirm if it is necessary to adjust the cap, if any, for highly compensated employees.