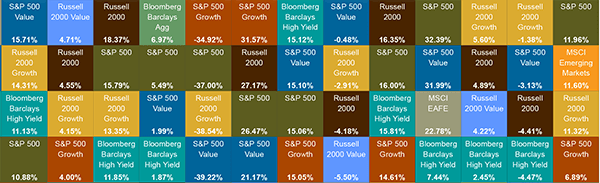

One glance at the crazy quilt of colors in the Periodic Table of Investment Returns suggests the challenge investors face in picking an investment class “winner” year-by-year and illustrates the benefit to diversification.

Last year offered investors a wild ride, with sentiment overwhelming fundamentals for much of 2016. Bonds rose in value and stocks fell through the Brexit vote in June and the U.S. presidential election in November, only to reverse course at the end of the fourth quarter. U.S. stocks surged, and the S&P 500 notched a 12% gain for the year, after a meager 1.4% increase in 2015. Bonds were up 2.7% (Bloomberg Barclays U.S. Aggregate Index), reflecting a retreat in value as interest rates rose in the fourth quarter, but actually showing an improvement in total return over 2015. Value and small cap U.S. stocks enjoyed banner years, with small cap value (Russell 2000 Value) leading the pack, jumping almost 32% after a loss of 7.5% in 2015. Emerging market equities enjoyed a similar reversal, gaining 11.6% after suffering a loss of 14.6% in the prior year. Developed market equities outside the U.S. (MSCI EAFE) trailed the pack, and eked out a return of just 1%.

The rankings of the various asset classes across the capital markets have been all over the map on a year-by-year basis since the Global Financial Crisis, with equity strategies returning as much as 43% in one year (Small Cap Growth in 2013) and suffering losses as great as -18% (Emerging Markets in 2011), all while the global equity markets were enjoying a broad bull market run. During this same period, the Bloomberg Barclays Aggregate ranked both first (2011) and last (2010 and 2012), all while generating a return in a very narrow range from -2.0% to 7.8%. The Periodic Table is a reminder that the results from investing are far from certain, and that absent the ability to pick the winner in advance, diversification is key to managing the risk of an investment portfolio.

The Callan Periodic Table of Investment Returns depicts annual results for various asset classes, ranked from best to worst, for the last 20 years. Each asset class is color-coded for easy tracking. Well-known, industry-standard market indices are used as proxies for each asset class. It is one of Callan’s most recognized pieces of research, widely cited in the media and much anticipated by our clients.