After celebrating U.S. tax cuts and deficit spending in the prior quarter, risk seekers tempered their buying enthusiasm in the second quarter when a global trade war threatened to crash the party. Casting shade on the growing but increasingly fragile global recovery, Trump’s posturing against China and other countries with U.S. trade surpluses caused non-U.S. stocks to retreat and U.S. stocks to advance more tentatively. Italy’s populist-driven election and China’s softening economy did not help risk appetites abroad.

Amid this turbulent economic setting, the dollar strengthened, further undermining the MSCI Emerging Markets Index (-8.0%) and spot gold (-5.5%). The MSCI EAFE Index slipped 1.2%. Although many commodity prices fell with a stronger dollar (ask Starbucks if you’d now like lower-priced sugar with your lower-priced coffee?), oil gained on supply constraints. Still-strong earnings momentum in the U.S. lifted the S&P 500 Index (+3.4%), as growth stocks outpaced value for the sixth quarter in a row amid large caps. Representing smaller companies less involved with global commerce, the Russell 2000 Index (+7.8%) was the quarter’s most productive trade among stockpickers. Ten-year Treasurys and investment-grade credits were flat, more or less, while lower-grade credits barely generated their coupon. Meanwhile, short-term U.S. interest rates continued to climb with steady Federal Reserve pressure.

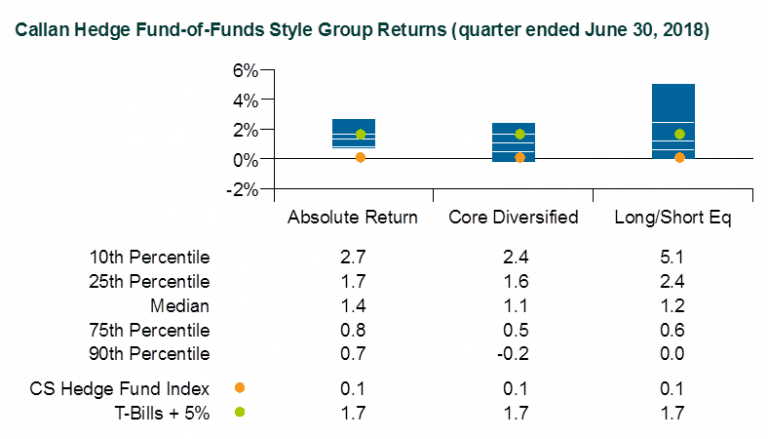

Given the quarter’s market twists, hedge funds harvested only marginal excess profits from their active bets across most strategies. Illustrating raw hedge fund performance without any oversight fees, the Credit Suisse Hedge Fund Index (CS HFI) rose 0.1% in the first quarter. Representing actual hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database gained 1.3%, net of all fees and expenses.

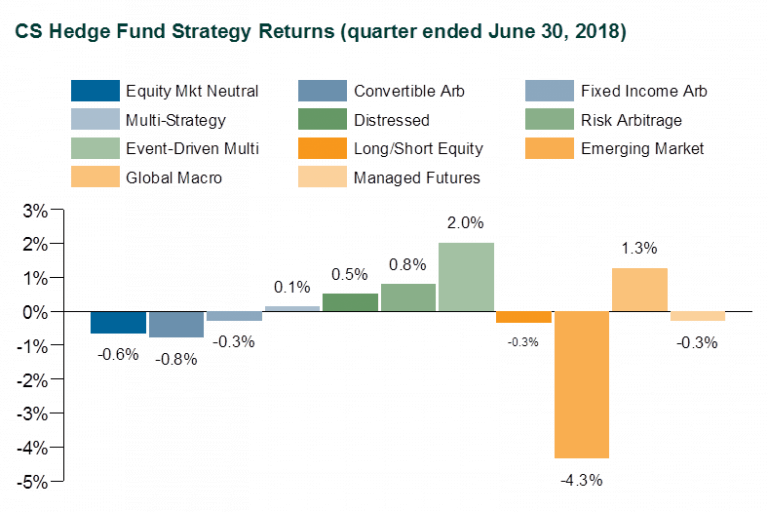

Within CS HFI, the best-performing strategy last quarter was Event-Driven Multi-Strategy (+2.0%), reflecting a resilient M&A market despite corporate boardroom uncertainty over global trade turmoil. Also benefitting from such corporate activity, Risk Arb gained 0.8%. Anticipating market opportunities from divergent monetary and economic paths, Global Macro advanced 1.3%. However, the systematic risk takers in Managed Futures lost 0.3%.

Emerging Markets (-4.3%) weathered the carnage better than the underlying equity and credit markets. Given the mixed performance across global equity markets and underlying sectors, Long/Short Equity slid 0.3%.

Within Callan’s Hedge Fund-of-Funds Database, market exposures did not materially impact performance in the second quarter. The median Callan Long/Short Equity FoF (+1.2%) roughly matched the Callan Absolute Return FoF (+1.4%). With diversifying exposures to both non-directional and directional styles, the Core Diversified FoF gained 1.1%.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

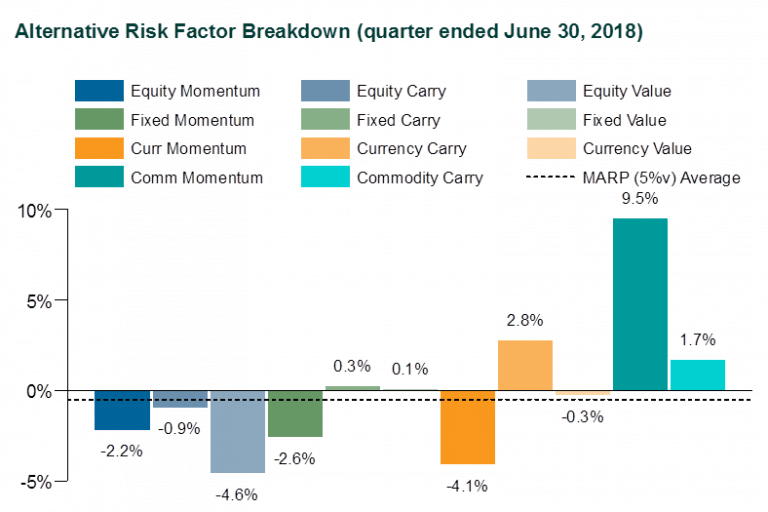

Measuring the performance of these alternative risk premia in the second quarter, the Credit Suisse Neuberger Multi-Asset Risk Premia Index slipped 0.5% based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, the biggest detractor was Equity Value (-4.6%), which had a similar loss in the first quarter. Benefitting from distinct price waves, Commodity Momentum surged 9.5%, but Equity Momentum (-2.2%), Fixed Momentum (-2.6%), and Currency Momentum (-4.1%) lacked profitable trends in their respective markets.

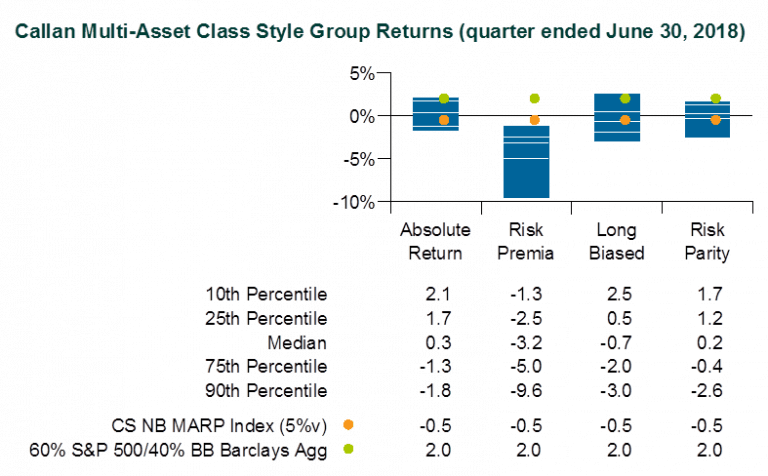

Within the Callan Multi-Asset Class (MAC) Style Groups, the median managers generated mixed results, gross of fees, depending on their underlying risk exposures. For example, the median Callan Risk Premia MAC fell 3.2%, as normally diversifying risk factors, like value and momentum, sank together. Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC edged ahead 0.2%. Despite a typically long equity bias within its dynamic asset allocation style, the Callan Long-Biased MAC fell 0.7% while a traditional unlevered benchmark of 60% S&P 500 and 40% Bloomberg Barclays US Aggregate Bond Index appreciated 2%. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the median Callan Absolute Return MAC gained 0.3%.