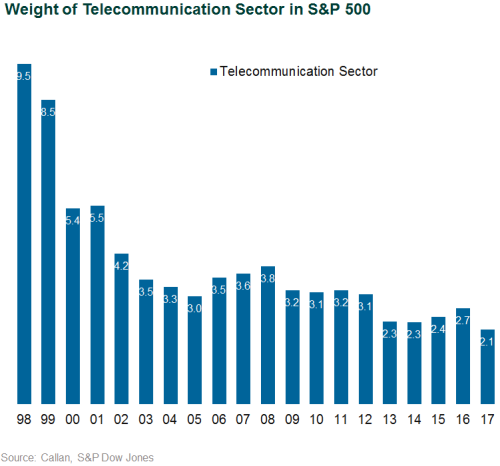

The Telecommunication Services sector has been shrinking; its share of the S&P 500 Index’s market value is just 2%, down from near 10% in 1989, and now includes only three companies. Telecom companies have been merging with media and internet firms in an attempt to diversify their exposure to the cellphone and internet industries.

To reflect these broad changes, the Global Industry Classification Standard (GICS) will undergo its biggest shift ever when the Telecommunication Services sector is revamped into a new Communication Services sector at the end of September to better reflect changing communication methods.

What Changes

The new Communication Services sector will include the existing Telecommunication Services companies (e.g., AT&T, Verizon). It will also include media companies from Consumer Discretionary (e.g., Comcast), select Retail companies within Consumer Discretionary (e.g., Netflix), and Internet Services companies within Information Technology (e.g., Alphabet and Facebook). E-commerce companies such as eBay will move from Information Technology to Consumer Discretionary.

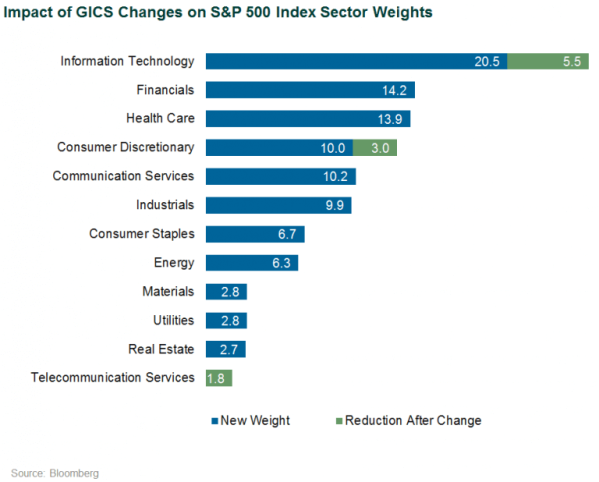

Within the S&P 500 Index, 17 stocks from Consumer Discretionary and seven stocks from Information Technology (IT) are moving to Communication Services. This change takes effect Friday, September 28, 2018, after close of business (ET).

According to State Street Global Advisors, this is the biggest shift in sector structure in GICS history, representing:

- 10% of the S&P 500 Index by market cap

- 100% of the S&P 500 Telecommunication Services Index

- 24% of the S&P 500 Consumer Discretionary Index

- 21% of the S&P 500 Information Technology Index

The change will also affect the performance impact of stocks that remain within the IT sector. As a result of the shift of certain stocks to the Communication sector, stocks that remain in the IT sector will have a greater impact on the sector’s performance, according to S&P Dow Jones Indices. If this change had happened in July 2017, the strong performance of Apple and Microsoft, and their larger share of the IT sector, would have increased the return of the sector to 33.3% for the one year ending July 31, 2018, the index provider calculated, compared to its actual gain of 28.5%.

New Sector’s Market Profile

Filled with high-dividend paying, bond-proxy stocks, the Telecommunication Services sector historically fell under the value style bucket. However, the profile of the new Communication Services sector will be more growth-oriented after the addition of stocks from the Consumer Discretionary and Information Technology sectors.

The new sector will also be more sensitive to the broader equity markets, SSGA research indicates. For the S&P 500 Index, the beta changes from 0.52 for the Telecommunication Services sector to 1.03 for the Communication Services sector. Dividend yield is over 5% for Telecom while less than 2% for Communication. Within the MSCI World Index, the Telecom sector was classified as defensive with a beta of 0.88; the Communication sector will be classified as cyclical with a beta of 0.99.

The Communication Services sector will be the “youngest” of the GICS sectors, measured by the date of the initial public offerings of its constituent companies, according to S&P Dow Jones. Approximately 60% of the sector’s market value will have less than 20 years of return performance data, the index provider notes, making analysis of the sector challenging.

Impact on Investors

Investors with exposure to sector funds may need to reevaluate their allocations. Owners of Technology and Consumer Discretionary index funds could experience taxable events. Passively managed Tech funds will not be able to own three of the five FAANG stocks; Facebook, Netflix, and Alphabet/Google belong to the new Communication Services sector. Active manager sector exposures may shift; overweights to the Tech and Consumer Discretionary sectors may decline while an overweight to Communication may emerge.

Some sector ETF providers started preparing for the changes early. To avoid having to make large trades when the changes go into effect, Vanguard has pegged its Technology, Telecommunication, and Consumer Discretionary sector ETFs to temporary benchmarks, adjusting gradually over four months. And its recently relabeled Communication Services fund already includes small investments in Alphabet and Facebook, according to Reuters.