To best serve employees, defined contribution (DC) plans need to evolve to meet the changing needs of the workforce and respond to the shifting regulatory landscape. For instance, the Baby Boom generation may require a greater focus on decumulation strategies, while the Generation X cohort may need more savings options, and those in the Millennial generation may look for help in saving more.

A top-tier DC plan is vital to offering a competitive benefits package that meets the organization’s goals and helps it recruit the best employees. This post will outline some new features that sponsors should consider for their plans.

Automating Savings

The percentage of DC plans with automatic enrollment increased dramatically following the Pension Protection Act (PPA) of 2006. The most common starting deferral rate has historically been 3%, but that rate will not generate sufficient retirement savings for most plan participants. Plan sponsors should consider whether a deferral rate at the match level is more appropriate. While this may increase the cost of employer contributions in the short term, it can support long-term labor management. Additionally, automatically increasing the deferral rate beyond the match level by 1% each year will continue to shore up employee savings behaviors, without increasing the cost of employer contributions.

Although automatic enrollment has historically been limited to pre-tax monies, there is nothing to preclude automatically enrolling participants in a Roth. Some plan sponsors may find that a Roth could be more appropriate for their employee population (e.g., younger workers) or in order to support tax diversification, since employer contributions are always considered a pre-tax source.

Plan sponsor consideration: Timing the escalation can be an important tool for plan sponsors in maintaining these rates—employees are less likely to notice the impact to their paycheck if the escalation takes place with the first paycheck following a raise.

Diversifying Tax Risk

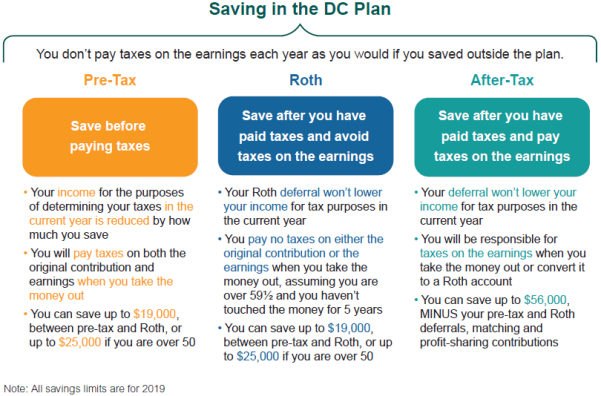

Plan sponsors can explore whether the opportunities to manage taxes in retirement will enhance decumulation options. This chart explores some of the features of pre-tax, Roth, and after-tax deferrals. The plan sponsor can look at how these features could be employed to maximize their effectiveness.

A plan with a Roth feature can also allow “in-plan conversions” or internal rollovers from another account within the plan. The plan sponsor can allow participants to convert existing pre-tax deferrals, employer contributions, and after-tax contributions.

Plan sponsor consideration: Some of these tax-diversifying strategies may require additional communication to employees because of their complexity. This may be folded in as a part of annual enrollment or other communication campaigns.

Saving Hacks

Employers recognize that saving for retirement might take a backseat to creating an emergency savings account for some employees. One potential solution is to allow after-tax contributions in the DC plan to serve as a form of emergency savings. Employers looking to utilize this feature could facilitate after-tax contributions up to a certain dollar amount and, depending on the recordkeeper’s capabilities, use that same deferral rate for additional contributions above that dollar amount to a pre-tax or Roth account. Deploying this savings opportunity and providing targeted employee communications could help improve related nondiscrimination testing issues.

Additionally, the sponsor can let employees who are currently maxing out their pre-tax or Roth deferrals to save additional amounts as after-tax, above the 402(g) limit ($19,000 in 2019, or $25,000 for participants age 50 or above).

Plan sponsor considerations: The sponsor should make clear to participants that any earnings on after-tax monies withdrawn before age 59½ are subject to taxation as well as a 10% premature distribution tax. This is in contrast to hardship withdrawals or defaulted loans of pre-tax amounts, where these taxes would apply to both the principal and the earnings. Additionally, the plan sponsor can conduct mid-year evaluations of its projected nondiscrimination test to confirm the impact of after-tax contributions, limit the amount available for highly compensated employees, or both.

Designing for Decumulation

Following the cycle of accumulating assets for retirement, plan sponsors need to evaluate how the DC plan can support the “decumulation” process. Some plan sponsors prefer to encourage non-employee participants to leave the plan and only permit lump sum distributions. This minimizes the potential fiduciary exposure for non-employee participants (e.g., investment selection and monitoring, or providing required notices). Other sponsors view the DC plan as a retirement vehicle and offer expanded distribution options to support participants throughout their retirement.

The sponsor can set the terms of the plan to permit participants to structure their distributions within certain frameworks:

- Lump sum distribution: participant receives entire balance at one time

- Installment distributions: a series of equal payments (either a dollar amount or a percentage of the balance) over a defined period of time

- Partial distributions: a one-time distribution of a portion of the account or recurring payments that can be altered at any time

- In-service withdrawals: draw-down of retirement savings to support a “phased retirement.”

- Fund-specific or money-source distributions: targeted distributions (e.g., from only pre-tax or only Roth sources or only specific investment vehicles)

Plan sponsor consideration: A sponsor should review its current and projected employee population to determine the needs and potential usage prior to adding these new features and confirm they align with the overall benefits philosophy employed by the organization. Plan sponsors should consider how transaction fees are structured, as the fees charged to participants can act as an unintentional barrier for participants that want to take partial or periodic discussions.

Coming soon

This blog post will be one of three on designing and managing a DC plan. The next two will address investment strategies and financial wellness.