1Q24 real estate performance summary

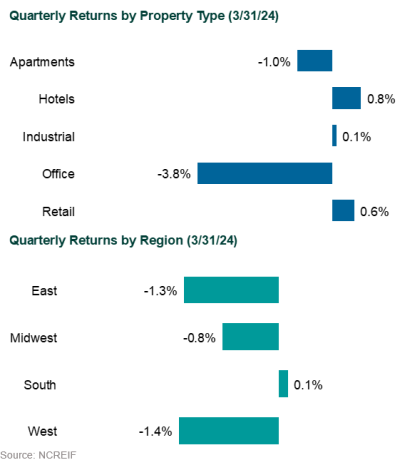

Private real estate indices saw gains from income, but negative appreciation returns set them back. Office continued to be hindered and was the worst-performing sector in the quarter.

The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, declined 1.1% during 1Q24. U.S. REITs, as measured by the FTSE Nareit Equity REITs Index, fell 0.2%. The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, declined 0.2%. European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), dropped 5.0%.

Appreciation returns drive NPI lower

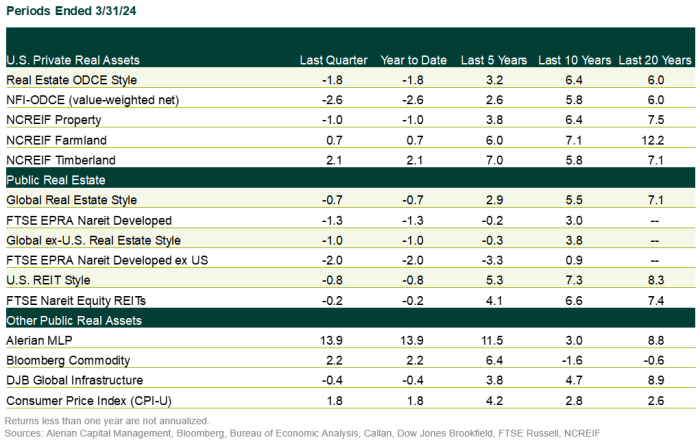

- The NCREIF Property Index, a measure of unlevered U.S. institutional real estate assets, fell 1.0% during 1Q24.

- The income return was 1.2% while the appreciation return was -2.1%.

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 0.8%. Office finished last with a loss of 3.8%.

- Regionally, the South led with a gain of 0.1%, while the West was the worst performer with a drop of 1.4%.

- The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, fell 2.6% during 1Q.

U.S. real estate securities

- U.S. REITs (-0.2%) underperformed the S&P 500 (+10.6%). The underperformance was driven by optimism about the broader economy and excitement about artificial intelligence, which drew capital flows away from REITs.

- Earnings growth for U.S. REITs is expected to be in the low single digits due to conservatism and elevated interest rates.

- Cyclical sectors including malls and lodging led U.S. REITs in 1Q, while net lease and storage trailed due to higher interest rate sensitivity and weak pricing power, respectively.

- Dampening inflation, coupled with more dovish Federal Reserve sentiment, sparked a rally to close the year.

Asia/Pacific real estate securities

- The FTSE EPRA Nareit Developed Asia Index (USD) fell 0.2% during the quarter. Strength in higher beta, growth-sensitive Japanese developers was a driver of the region’s relative outperformance.

- Hong Kong was the primary underperformer due to concerns over a sustainable pickup in China growth momentum.

European real estate securities

- The FTSE EPRA Nareit Developed Europe Index (USD) dropped by 5.0% during the quarter.

- Europe was the lowest-performing region, driven by signs of stickier inflation driving a repricing of rate cut expectations.

- The less-indebted U.K. outperformed continental Europe.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.