Private U.S. Real Estate

- The continued impact of the pandemic was reflected in 2Q20 results.

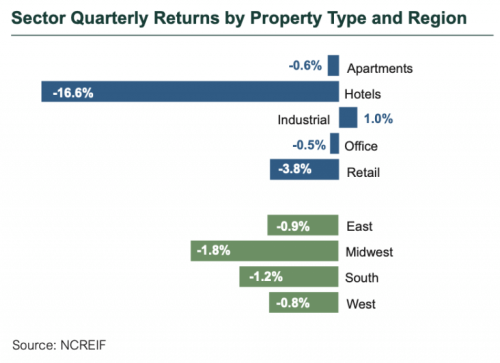

- All sectors of the NCREIF Property Index saw negative appreciation, but income remained positive except in the Hotel sector.

- Industrial remains the best performer.

- The dispersion of returns by manager within the NFI ODCE Index was due to both the composition of underlying portfolios and different valuation methodologies/approaches.

- Negative returns are expected over the next few quarters.

- Vacancy rates for all property types are or will be impacted.

- Net operating income has declined as retail experienced the largest drop-off in over 20 years.

- Second quarter rent collections show relatively stable income throughout the quarter in the Industrial, Apartment, and Office sectors. The Retail sector remains challenged, with regional malls impacted most heavily.

- Class A/B urban apartments were relatively strong, followed by certain types of Industrial and Office.

- Supply was in check before the pandemic.

- Construction is limited to finishing up existing projects but has been hampered by shelter-in-place policies and shortages of materials.

- New construction will be basically halted in future quarters except for pre-leased properties.

- Transaction volume has dropped off during the quarter with the exception of Industrial assets that have tenants with strong credit, which are trading at pre-COVID-19 levels.

- Cap rates remained steady during the quarter. The spread between cap rates and 10-year Treasuries is relatively high, leading some market participants to speculate that cap rates may not adjust much. Price discovery is happening and there are limited transactions.

- Callan believes the pandemic may cause a permanent re-pricing of risk across property types. Property types with more reliable cash flows will experience less of a change in cap rates; however, those with less reliable cash flows will see greater adjustments.

U.S. and Global REITs

- Global REITs underperformed in 2Q20, gaining 10.1% compared to 19.4% for global equities (MSCI World).

- U.S. REITs rose 11.8% in 2Q20, lagging the S&P 500 Index, which jumped 20.5%.

- Globally, REITs (except in Singapore) are trading at a discount to NAV.

- In some regions the discount is at a five-year low.

- All property types except for data centers, hotels, and life sciences are trading at the bottom of their range.

- Ongoing volatility in REIT share prices offers opportunities to purchase mispriced securities, individual assets from REIT owners, and discounted debt, as well as lend to companies and/or execute take-privates of public companies.

Infrastructure

- 1Q20 was the third-largest quarter for closed-end infrastructure fundraising ($37 billion), following 4Q19 ($43 billion) and 3Q18 ($38 billion). The closed-end fund market continues to expand, with infrastructure debt, emerging markets, and sector-specific strategies (e.g., communications and renewables). Investor interest in mezzanine or debt-focused funds has increased.

- Open-end funds raised significant capital in 2019, and the universe of investable funds continues to increase as the sector matures.

- In 2020 assets with guaranteed/contracted revenue or more inelastic demand patterns (e.g., renewables, telecoms, and utilities) fared better than assets with GDP/demand-based revenue (e.g., airports, seaports, and midstream-related).