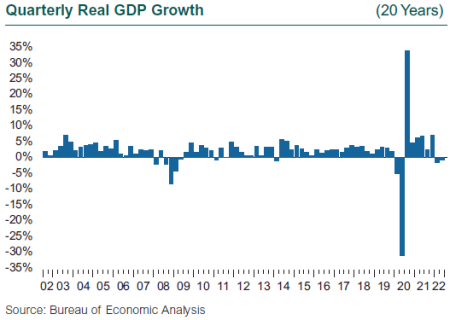

GDP in 2Q22 fell 0.9%, after declining 1.6% in 1Q—so are we already in a recession? If so, that was fast; growth in 4Q21 was a rockin’ 6.9%. The stock market already thinks so; investors fully priced in a recession during the first half of 2022, with particularly large declines in April and June and a bear market by midyear. Over history, the stock market moves to price in a recession well before the economic data begin to show a decline.

It turns out two consecutive quarters of falling GDP is a nice rule of thumb, but it is not the official definition of recession. So what is, and who gets to decide? First, the decider: the rather grandly named National Bureau of Economic Research Business Cycle Dating Committee. Second, the definition: “a significant decline in economic activity that is spread across the country and lasts more than a few months.” The committee uses a number of measures of economic activity, and leans particularly hard on real personal income and nonfarm payroll employment. Interestingly, GDP is used sparingly; the focus of recession dating is typically on a monthly determination of peaks and troughs, while GDP is reported only quarterly.

Data preferences from this arcane Dating Committee aside, two consecutive quarters of GDP decline is still news, even if it does not necessarily indicate recession. The sources of the decline in 2Q GDP included a large decrease in private inventory investment, which subtracted 2 percentage points from GDP. The inventory drop was led by a decrease in retail trade, mainly general merchandise stores, along with motor vehicle dealers. Other detractors to growth were both residential and non-residential fixed investment; and federal, state, and local government spending.

Offsetting the declines were increases in exports and personal consumption expenditures (PCE). The rise in PCE reflected an increase in services (food services, accommodations, and health care) that was partly offset by a decrease in spending on goods (led by food and beverages). So … more spending on restaurants and hotels and Airbnbs, and less food at home, even with the sharp rise in prices at the grocery store.

What is especially interesting is that the rise in the dollar helped imports and didn’t seem to hurt exports, which is very weird, since that rise makes our exports more expensive and our imports cheaper. Exports fell sharply in 1Q as Russia invaded Ukraine, yet as the war intensified, exports shot back up in 2Q, growing by 18% and contributing almost 2 percentage points to GDP growth. Returning to the premise of the Dating Committee, that much more than GDP growth should define a recession, somewhat anomalous components of GDP accounted for the declines in 1Q and 2Q. Both quarters were driven by huge changes in exports and inventories, neither of which are usually so important to a given quarter’s GDP growth, and do not often reverse the course of growth coming from the rest of the economy.

Other Data on the Economy Not as Grim

Other data on the broad economy during the first half of 2022 do not necessarily point to a recession, at least not yet. The job market was very robust through both 1Q and 2Q, as the U.S. economy added more than 2.7 million new jobs; since the invasion of Ukraine in February, the job market averaged almost 400,000 new jobs per month, substantially above the 200,000-250,000 rate that indicates an expanding economy. We still have room to recover from the pandemic, however, as we are half a million jobs short of the level set in February 2020.

Disposable personal income increased 6.6% in 2Q, in contrast to a decline of 1.3% in 1Q. Despite this robust growth, incomes could not keep up with inflation, which began ramping up in April 2021. After kicking off the year at 7.5% in January, inflation as measured by the CPI-U index has only gone up each month, reaching 9.1% in the June report. As a result, real disposable personal income (take-home pay, adjusted for inflation) decreased 0.5% in 2Q; while disappointing, this report was substantially better than in 1Q, when real disposable income fell an alarming 7.8%.

The mayhem in the capital markets continued during 2Q, as both stocks and bonds responded to the Fed and the ECB aggressively raising interest rates, Russia’s war in Ukraine, concerns about an incipient recession, another COVID surge, and global economic weakness. However, the U.S. economy is still growing robustly. There may be something to this Dating Committee’s methodical approach. The caveat to its work is that calling turning points relies on government data reported with lags, so the Committee can only designate a recession after it starts. We may be “there,” but we will not know until the Committee decides.