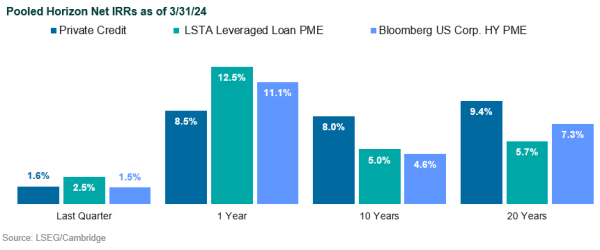

Over the past 10 years private credit has generated a net IRR of 8.0%, outperforming leveraged loans as of 1Q24. Higher-risk strategies have performed better than lower-risk strategies.

Key trends in private credit

- U.S. sub-investment grade corporate yields rose dramatically at the beginning of 2022 with yields peaking in September. This was a combination of higher interest rates due to tighter Fed policy and a widening of high yield spreads. Effective yields continued to drop in 1Q24.

- Spreads contracted during 1Q24, a continuation from late 2023, due to stronger credit conditions as the U.S. economic outlook improved.

- Default rates for U.S. corporate bonds and loans in 2024 continued to slightly rise but remained in the historical average of 3% – 4%.

- The Corporate Bond Market Distress Index (CMDI) rose rapidly during 2022, especially for investment grade bonds, but has fallen since then. In 2024, both the investment grade distress and high yield bond indicator continued to fall, a trend that has proceeded since last year.

- Private credit assets under management (AUM) stood at over $1.5 trillion at the end of 2023, with Preqin forecasting the asset class will grow to over $2.5 trillion by 2028 at a 11.13% compound annual growth rate from 2023 to 2028.

- Direct lending is expected to grow steadily through 2028 as investors increase their private credit allocations. Distressed exposure should grow a bit more slowly with other strategies such as opportunistic, special situations, and other niche diversifiers growing more quickly.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.