2Q24 real estate performance summary

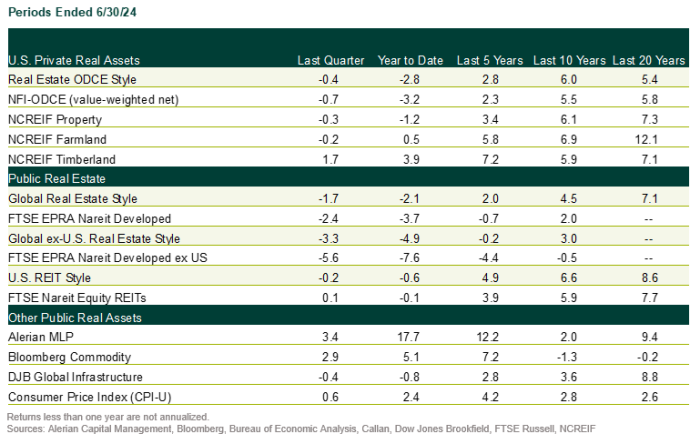

Major private real estate indices fell in 2Q24, although income returns were positive. U.S. REITs gained but trailed the S&P 500 Index, while global REITs fell even as global equities rose. Redemption queues as a percentage of net asset value are above the level hit during the Global Financial Crisis. Transaction volume in 2Q24 flattened but is below the five-year average.

Private real estate | The NCREIF Property Index, a measure of U.S. institutional real estate assets, fell 0.3% during 2Q24. The income return was 1.2% while the appreciation return was –1.4%.

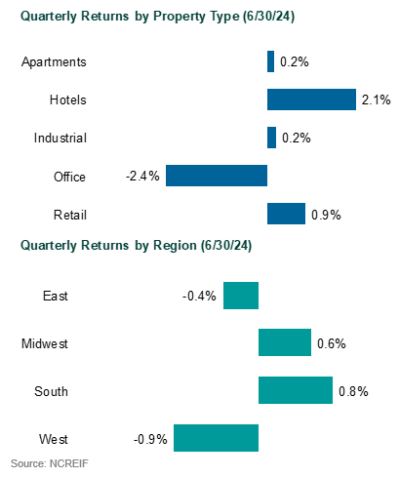

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 2.1%. Office finished last with a loss of 2.4%.

- Regionally, the South led with a gain of 0.8%, while the West was the worst performer with a drop of 0.9%.

The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, fell 0.5% during 2Q, with an income return of 1.0% and an appreciation return of -1.5%.

Valuations are reflective of higher interest rates, which have put upward pressure on capitalization rate and discount rate assumptions. NCREIF Property Index income returns were positive across sectors and regions. All property sectors and regions experienced negative appreciation, except for hotels.

Public real estate | Global REITs underperformed in 2Q24, declining 2.4% compared to a 2.6% increase for global equities (MSCI World). U.S. REITs gained 0.1% in 2Q24, in contrast with the S&P 500 Index, which rose 4.3%.

REITs continue to trade at a discount to NAV (-4.2%) and offer some relative value given this spread. Historically, global REITS have traded at a -4.0% discount to NAV.

- The underperformance in U.S. REITs was driven by the Fed signaling a single rate cut despite weakening inflation and softening economic data.

- While equities were once again led by tech stocks, industrials underperformed due to weakening tenant demand and new supply.

- Apartments outperformed, driven by persistent strength in fundamentals and strong M&A transactions.

- U.S. REITs raised $16.6 billion during the quarter in nine common share offerings, four secondary preferred equity offerings, and 31 unsecured debt offerings.

Global REITs fall

The FTSE EPRA Nareit Developed Asia Index (USD) dropped 8.0% during the quarter. Asia was the lowest-performing region, driven by yen weakening and the need for potential rate hikes from the Bank of Japan. Japanese developers gave back some gains driven by profit-taking. Australia was the outperformer of the region driven by an industrial company with exposure to data centers joining the index.

The FTSE EPRA Nareit Developed Europe Index (USD) decreased by 5.0% during the quarter. Central banks across Europe began pivoting monetary policy and began cutting interest rates, while the Bank of England has held interest rates level due to persistent inflation. Self-storage outperformed in the United Kingdom due to improved fundamentals and some acquisition activity. Sweden lagged due to high loan-to-value ratios and floating-rate debt exposure weighing on real estate companies. French REITs lagged due to economic uncertainty driven by snap elections.

Redemption queues | Current ODCE redemption queues are approximately 17.3% of net asset value, with a median queue of 13.9%. This compares to the GFC when queues peaked at approximately 15% of NAV.

- Outstanding redemption requests for most large ODCE funds are approximately 11% to 20% of net asset value.

- For a large proportion of funds, these redemptions are partial redemptions, due to portfolio rebalancing and liquidity needs.

- For a smaller underperforming subset, redemption requests are full redemptions indicative of manager termination.

Transactions | Transaction volume has flattened on a rolling four-quarter basis and remains well below five-year averages.

- In 2Q24, transaction volume increased slightly on a quarter-over-quarter basis. Transaction volume remains significantly lower compared to 2022.

- The volatile rise in interest rates is the driving force behind the slowdown in transactions.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.