Global fixed income markets generally performed well in the third quarter. Moderate growth and inflation kept long-term rates low and range bound in the U.S. Rates were also low outside the U.S., but dollar weakness boosted returns.

U.S. Bonds: Low Volatility Drove Returns

Yields rose modestly, particularly on the short end of the U.S. Treasury yield curve. The 10-year Treasury yield touched 2.00% during the quarter on geopolitical risks related to North Korea, but ended the quarter at 2.33%. Volatility in fixed income markets (as well as equities) sat at near historic lows; the overall risk appetite remained strong. And in general, lower-rated credits again outperformed investment grade.

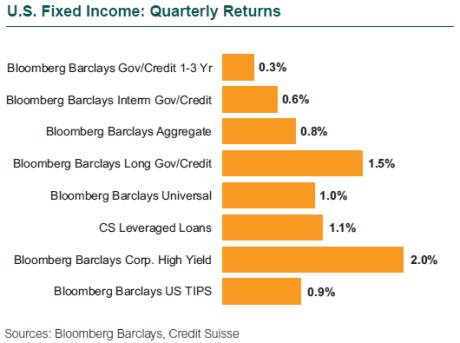

The Bloomberg Barclays U.S. Aggregate Bond Index was up 0.8% in the quarter. The Bloomberg Barclays U.S. Corporate Bond Index rose 1.3%. High yield corporates fared even better, with the Bloomberg Barclays U.S. Corporate High Yield Bond Index up 2.0%.

TIPS rebounded from their underperformance in the previous quarter. The Bloomberg Barclays U.S. TIPS Index rose 0.9% and the 10-year breakeven spread (the difference between nominal and real yields) rose to 1.84% as of quarter-end from 1.73% at the end of the second quarter.

Corporate credit spreads tightened on strong demand and robust corporate earnings. Financials and Utilities were the leading sectors during the quarter. High yield credit continued to perform well, aided by the hunt for yield. The upward trend in earnings along with corporate discipline has led to the highest rating agency upgrade-downgrade ratio since 2013.

The municipal bond market also performed well; the Bloomberg Barclays Municipal Bond Index returned 1.1% for the quarter and the shorter duration 1-10 Year Blend Index was up 0.7%.

Global Bonds: Many Reasons to Cheer

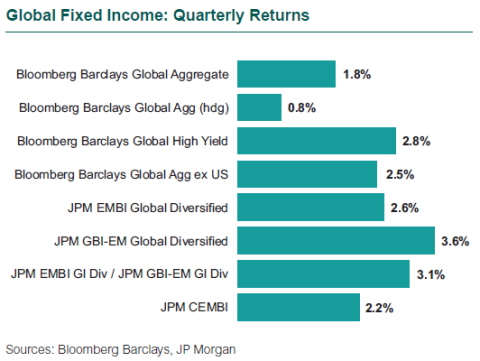

Rates were also steady overseas, though dollar weakness boosted returns. The Bloomberg Barclays Global Aggregate Index returned +1.8% (unhedged) versus +0.8% for the hedged version.

Emerging market debt also posted solid returns. The JPM EMBI Global Diversified Index ($ denominated) was up 2.6%. Gains were broad-based with only beleaguered Venezuela (-11%) down. The local currency JPM GBI-EM Global Diversified Index increased +3.6%. Returns were mixed for this index, with Brazil (+11%) being the best performer and Argentina’s first-ever local bonds (-4%) being the worst on worries over the success of reforms.