Low volatility and gently rising markets fostered ongoing “Golden Era” conditions in the private equity market. Fundraising is on pace to best last year’s post-GFC high; buyout and venture investments slowed slightly but dollar volume remained healthy.

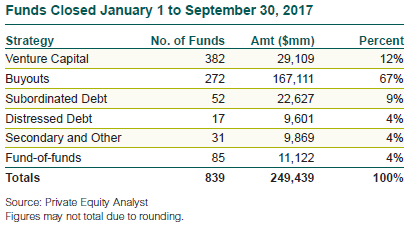

Third quarter private equity partnership commitments totaled $84.0 billion, with 210 new partnerships formed, according to Private Equity Analyst. The number of funds raised decreased 34% from 319 in the second quarter, but the dollar volume dipped only 2% from $85.0 billion. Apollo IX is the largest fund raised so far in 2017, holding a $24.6 billion final close in the third quarter—and it is the largest buyout fund ever raised.

Investments by buyout funds into companies totaled 446 deals, down 12% from 504 in the prior quarter, according to Buyouts newsletter. The announced total volume was $51 billion, up 6% from $48 billion in the second quarter. The quarter’s largest deal was the $7.5 billion take-private of Panera Bread by JAB, a family-owned holding company. Sixteen deals with announced values of $1 billion or more closed in the quarter.

New investments in venture capital companies totaled 1,706 rounds of financing with $21.5 billion of announced value, according to the National Venture Capital Association (NVCA). The number of rounds declined 21% from the 2,164 in the second quarter, and announced dollar value decreased 6% from $22.9 billion.

Buyouts reported that there were 160 private M&A exits of buyout-backed companies, with announced values totaling $34.4 billion. The M&A exits were down 1% from the prior quarter’s 161, but the announced value jumped 88% from $18.3 billion. Buyout-backed IPOs in the third quarter fell to only one raising $43 million, a sharp decrease compared to last quarter’s seven IPOs (a two-year high), raising an aggregate $2.0 billion.

Venture-backed exits (both private sales and IPOs) totaled 182 transactions, and disclosed value totaled $11.2 billion. The number of exits rose 2% from the second quarter’s 179, and the announced dollar volume increased 9% from $10.3 billion.

24.6

The amount, in billions of dollars, raised by Apollo IX, the largest buyout fund ever.