While private equity fundraising and investment measures in 3Q23 fell from 2Q, exits were a bright spot with dollar volume increases for buyout and venture M&A and buyout IPO volumes. The number of venture IPOs increased as well.

3Q23 private equity activity, from fundraising to exits

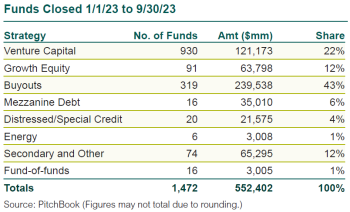

Fundraising | Based on preliminary data, private equity partnerships holding final closes in 3Q totaled $171 billion, with 435 new partnerships formed (unless otherwise noted, all data are from PitchBook). The dollar volume fell 13% from 2Q23, and the number of funds holding final closes declined 19%. So far, capital raised is running only 22% behind YTD 2022, but the number of funds trails by 42%.

Buyouts | New buyout transactions and dollar volume fell moderately. Funds closed 2,398 company investments with $123 billion of disclosed deal value, a 16% decrease in count and an 8% drop in dollar value from 2Q23.

VC Investments | New financing rounds in venture capital companies totaled 8,977, with $82 billion of announced value. The number of investments was down 21% from the prior quarter, but the announced value fell only 1%.

Exits | There were 507 private M&A exits of private equity-backed companies (excluding venture capital), with disclosed values totaling $123 billion. Exits fell 7% from the prior quarter but announced dollar volume increased 23%. There were 43 private equity-backed IPOs in 3Q raising $12 billion, the count fell by 2 IPOs but dollar volume leapt 50%.

Venture-backed M&A exits totaled 489 with disclosed value of $27 billion. The number of sales declined 10% but announced dollar volume jumped 93%. There were 102 VC-backed IPOs (up 19% from 2Q) but the combined float fell to $10 billion.

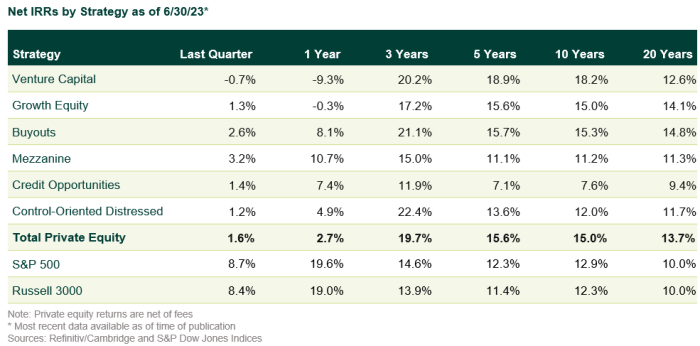

Returns | With the significant 2Q rally in public equity markets, private equity trailed for the quarter and last 12 months. Private equity posted a third consecutive quarterly gain after the large retreat across most of 2022. Continued capital markets volatility is expected, and private equity should provide a beneficial dampening effect.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.