Listen to This Blog Post

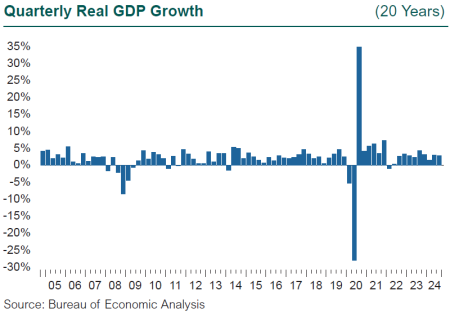

Growth in the U.S. economy continues to defy a steady drumbeat of negative perception. Real GDP clocked a 2.8% rate of growth in 3Q24, after an equally robust 3.0% rate in 2Q. The rate of job creation has clearly slowed from that of 2022 and 2023, but September saw a monthly gain of 254,000, and the U.S. economy has averaged 200,000 new jobs per month so far this year. The rule of thumb in economics is that a rate of monthly job creation at or above 200,000 means the economy is expanding. The unemployment rate is still low at 4.1%, and weekly claims for unemployment benefits have dropped over the five months ending in September.

So overall economic growth is solid, far stronger than expected at the start of the year, the job market is robust, and incomes and wages have risen substantially. Yet a downbeat mood is pervasive, in seeming defiance of these sunny economic reports.

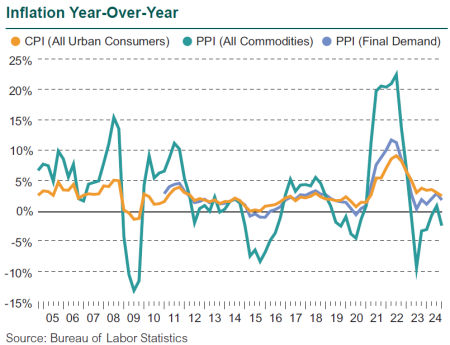

Inflation has eased, but it doesn’t feel like it to households and businesses alike. The cumulative impact on the cost of living from a generational spike in inflation looms large and is likely the chief culprit in the overall “bummer mood,” to use the technical term, in the economy. The annual rate of inflation may have come back to 2.4% in September, but it is still positive, which means prices are still rising, just less quickly. Even if inflation goes to zero, prices will remain elevated; we’d need deflation to bring prices down. Deflation is kryptonite to economic policy.

For businesses and government, the cost of goods and labor are now at substantially higher levels than four years ago. For households, higher wages help offset the higher costs of goods, services, and shelter, which is good. Average hourly earnings rose 20% between September 2020 and September 2024. However, the cost of new homes, rent, utilities, and groceries rose faster than wages over this period. Auto and home insurance are the new thorns in the consumer’s side; the price index for auto insurance rose 16.3% year-over-year in September. The 2.4% rise in CPI in September was held down by a 15.3% drop in gasoline prices and similar declines in other energy-related sectors. Note that utility prices did not benefit from this drop in fuel prices over the past year, as they rose 3.4%.

Digging through some of the details in the economic reports, the main driver of the strong 3Q GDP was consumer spending, spurred in large part by the strong job market. The leading categories of spending on services were health care (think outpatient services), hospitality, and accommodation; these are highly discretionary expenditures. Within goods, prescription drugs led non-durable goods, while motor vehicles and parts led durable goods spending. Business spending on equipment and intellectual property continued a long run of positive growth, likely driven in part by the frenzy around AI.

However, one of the main detractors to growth in 3Q24 was a reduction in inventory investment, the fifth negative quarter for inventory since the start of 2023. The steady drumbeat of a coming recession and Fed rate cuts may be to blame for spooking inventory investment. Finally, the housing market contracted for the second consecutive quarter, with “contraction” defined as a decline in residential housing investment. Housing prices remain elevated due to an unusual combination of high interest rates and limited supply. High rates would normally soften demand and push down prices, but the supply of homes for sale is limited, as existing homeowners choose to stay in their homes rather than face the higher cost of a new mortgage.

The Fed stepped up and cut interest rates 50 bps in September, only to now face the reality of a stronger economy than expected. The concern for some market participants is that the Fed move will spur exuberance in spending, and goose the stock market further, and this exuberance will potentially trigger a return of inflationary pressures, or at the least, slow the progress on bringing inflation down and keeping it there. The market sentiment on rate changes has been so far ahead of itself these past two years; it has become an unreliable narrator. If rates remain high for a while longer, that scenario suggests continuing economic growth—a good thing, right? If rates start to tail down, that scenario is often an indicator of growing economic problems. The challenge for Fed policy is that no elected official wants higher interest rates, at least not on their watch, and this is an election year.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.