Listen to This Blog Post

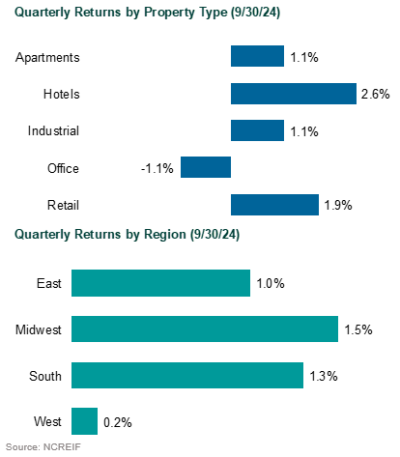

After eight consecutive quarters of negative returns, valuations have adjusted to reflect higher borrowing costs. Income returns were positive across sectors and regions in 3Q24, with Hotels the top performer. All property sectors saw flat or positive appreciation, except for Office.

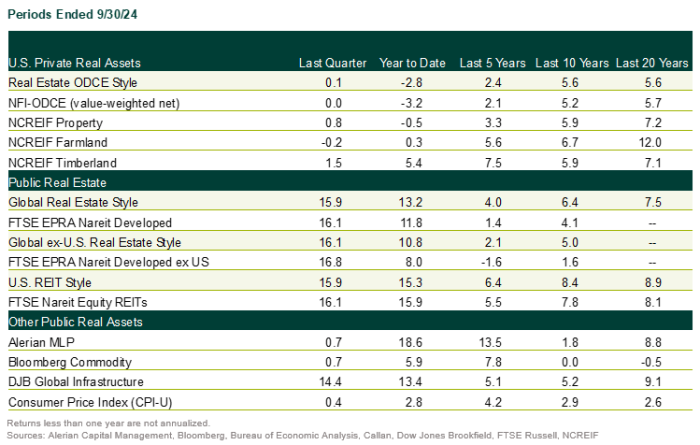

REITs in the U.S. and globally outperformed equities, with U.S. REITs topping their global peers.

3Q24 real estate performance summary

Private real estate | Appreciation by sector turned positive, outside of Office. Income returns were positive across sectors and regions. The NCREIF Property Index, a measure of U.S. institutional real estate assets, rose 0.8% during 3Q24. The income return was 1.2% while the appreciation return was –0.4%.

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 2.7%.

- Office finished last with a loss of 1.1%.

- The Midwest led with a gain of 1.5%.

- The West was the worst performer with a gain of just 0.2%.

The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, rose 0.3% during 3Q, with an income return of 1.0% and an appreciation return of -0.8%.

Public real estate | U.S. REITs (16.1%) outperformed the S&P 500 (5.9%) in 3Q along with Asian REITs and European REITs. The outperformance in U.S. REITs was driven by lower interest rates. REITs broadly outperformed equities with the exception of the Utilities sector.

- Single-family rentals underperformed due to lower expected rates decreasing the affordability gap.

- Hotels underperformed due to lower guidance on expected leisure travel.

- Office outperformed, driven by lower rate expectations in the leveraged sector and pending maturities.

- Self-storage outperformed as 30-year mortgage rates fell; a recovery in housing would improve demand for the sector.

The FTSE EPRA Nareit Developed Asia Index (USD) gained 15.9%. Asian markets benefited from expectations of further U.S. rate cuts. Chinese monetary policy and expected fiscal stimulus was a tailwind for Hong Kong and Singapore markets. Japan lagged as the yen’s strength negatively impacted Japanese developers. Australia outperformed driven by rate-sensitive REITs.

The FTSE EPRA Nareit Developed Europe Index (USD) increased by 17.1% during the quarter. Central banks across Europe cut interest rates, which drove outperformance. The Bank of England lagged broader Europe in rate cuts due to persistent inflation. Lower interest rates were a tailwind for the housing sector led by the German housing sector. Hotel stocks slowed after a strong start to the year, and industrial REITs are slowing down compared to past years.

REITs are trading at a premium to net asset value (NAV) (+2.0%) for the first time since January 2022. Historically, global REITS have traded at a -3.8% discount to NAV.

Redemption queues | Redemption queues for core real estate funds are approximately 18.9% of NAV, with a median queue of 15.0%. This compares to the Global Financial Crisis, when queues peaked at approximately 15% of NAV. Outstanding redemption requests for most large core funds are approximately 6% to 33% of NAV (there is one outlier at 56%).

For a large proportion of funds, these redemptions are partial redemptions, due to portfolio rebalancing and liquidity needs. For a smaller, underperforming subset, redemption requests are full redemptions indicative of manager termination.

Transactions | Transaction volume is increasing on a rolling four-quarter basis yet remains below five-year averages.

In 3Q24, transaction volume increased slightly on a quarter-over-quarter basis. Transaction volume remains significantly lower compared to 2022.

The volatile rise in interest rates is the driving force behind the slowdown in transactions. Increasing transactions are driven by increasing confidence in multi-family and industrial values. Valuations have largely adjusted to increased borrowing costs.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.