The number of transactions fell modestly for 2018 and in the fourth quarter, reflecting less certainty in more volatile—and trickier—capital markets. However, dollar volumes associated primarily with fundraising, as well as venture capital (VC) investments and exits, increased. Overall activity remains near record levels.

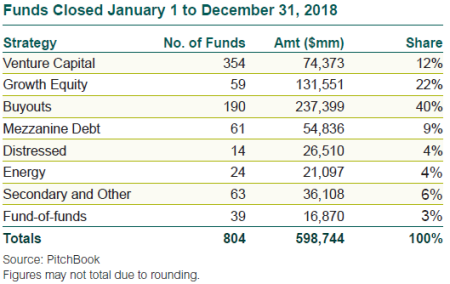

Fundraising: In 2018, private equity partnerships holding final closes raised $599 billion globally across 804 partnerships (unless otherwise noted, PitchBook provided all private equity data cited). The amount rose 6% from $566 billion in 2017, but the number of funds fell 19% from 995.

Final closes accounted for $112 billion in the fourth quarter, down 27% from $154 billion in the third quarter. The number totaled 164, down 20% from 206.

Buyouts: New buyout transactions for 2018 totaled 7,402 investments, down 4% from 7,738 in 2017. Dollar volume fell to $630 billion, a 3% drop from $649 billion.

The fourth quarter saw 1,571 new investments, dropping 16% from 1,868 in the third quarter, but dollar volume rose to $158 billion, a 3% uptick from $153 billion.

VC Investments: The year produced 20,632 rounds of new investment in VC companies, down 23% from 2017’s 26,668. The announced volume of $253 billion is up 53% from $165 billion.

The fourth quarter saw 3,654 new rounds, 24% down from 4,787 in the third quarter, and dollar volume fell to $51 billion, a 6% drop.

Exits: The year saw 145 buyout-backed IPOs in 2018, down 37% from 230 in 2017, with proceeds of $44 billion, down 19%.

The fourth quarter saw 21 IPOs, down 16% from the third quarter, with proceeds of $9 billion, up 50%.

Venture-backed M&A exits for the year totaled 1,375, down 16% from 1,646 in 2017. Announced dollar volume was $140 billion, up 43% from $98 billion in 2017.

The quarter had 295 exits, down 9% from 325 in the third quarter. The fourth quarter’s total announced value of $37 billion was down 8%.

The year saw 190 venture-backed IPOs, down 3% from 2017, raising $44 billion, up 132% from 2017.

The fourth quarter had 33 IPOs, down 40% from the third quarter. The fourth quarter float of $4 billion plunged 78% from $18 billion.