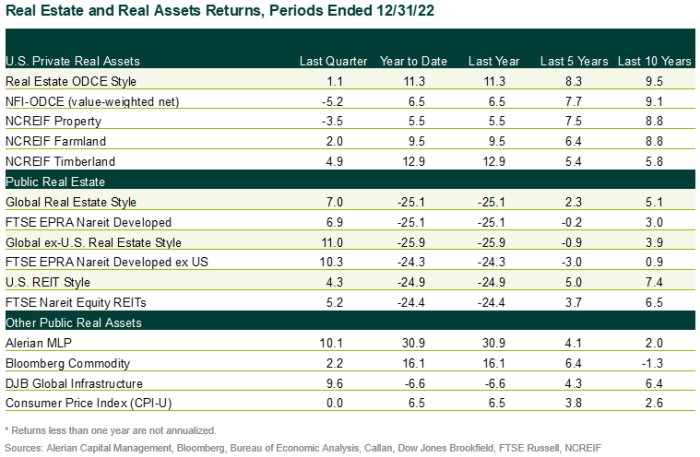

Private real estate indices fell in 4Q22, while REITs both in the U.S. and globally lagged equities. The real estate transaction market is slowing, signalling a difference between buyer valuations and seller expectations, which could result in slower sales/acquisitions activity by fund managers.

The denominator effect is beginning to impact investors: Private assets are just starting to reflect repricing, while the equity market correction has reduced overall fund values, resulting in allocations to real estate meeting or exceeding targets.

Real assets did well in 4Q but full-year results were poor except for energy-related indices.

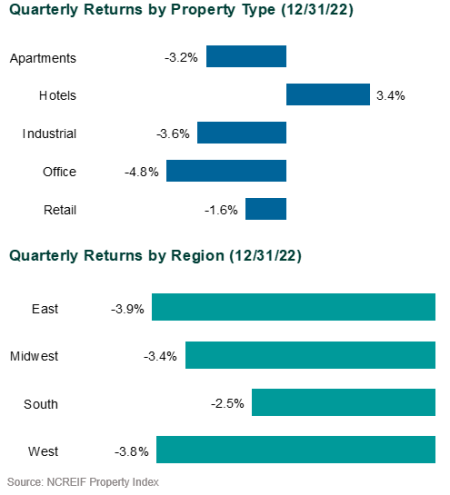

Negative Appreciation in Major Real Estate Sectors

- The NCREIF Property Index, a measure of U.S. institutional real estate assets, fell 3.5% during 4Q. The income return was 1.0% while the appreciation return was -4.5%.

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 3.4%. Office finished last with a loss of 4.8%.

- Regionally, the South led with a decline of 2.5%, while the East was the worst performer with a drop of 3.9%.

- All major property sectors and regions, except for Hotels, experienced negative appreciation.

- The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, fell 5.2% during 4Q, with an income return of 0.59% and an appreciation return of -5.76%.

REITs Lagged Equity Indices

- U.S. REITs, as measured by the FTSE Nareit Equity REITs Index, rose 5.2%, in contrast with the S&P 500 Index, which gained 7.6%.

- Despite strong earnings, forward REIT earnings estimates continued to weaken, reflecting the potential for an economic slowdown as well as financing cost pressures.

- Retail and industrial were relatively resilient, driven by healthy leasing activity and guidance upgrades.

- Residential REITs were negatively impacted by elevated expenses and moderating pricing power.

- Office stocks lagged due to several high-profile technology companies announcing layoffs, continued headwinds related to remote work, and larger negative earnings estimate revisions.

- The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, rose 6.9% during 4Q22 compared to a 9.8% increase for global equities (MSCI World).

- The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, rose 9.0%, lifted by a rally in rate-sensitive Australian REITs.

- European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), rose 13.9%, driven by currency tailwinds in both the euro and the pound.

Real Assets Held Up in the Quarter

- Real assets as a group performed well in 4Q.

- The S&P GSCI Index rose 3.4%; Gold (S&P Gold Spot Price Index: +9.2%), REITs (MSCI US REIT: +5.2%), infrastructure (DJB Global Infrastructure: +9.6%), and TIPS (Bloomberg TIPS: +2.0%) all posted solid returns.

- Full-year results remained poor, however, for most real assets outside of those related to energy. The Alerian MLP Index gained 30.9% as it benefited from higher energy prices.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.