Listen to This Blog Post

U.S. equity markets ended 4Q24 in positive territory, following the U.S. election, the Federal Reserve interest rate cut, and strong economic data. Markets gave back some of that performance in December, as investors grew concerned about inflation and the potential slowdown in future rate cuts. Credit indices generated mixed returns during the quarter, with high yield outperforming investment grade bonds. The 10-year Treasury yield rose throughout the quarter and ended the year at 4.6%.

4Q24 Hedge Fund Performance

The S&P 500 gained 2.4%, with performance driven by earnings growth as rising rates caused the market’s price-to-earnings ratio to modestly decline despite the Fed cutting interest rates 50 basis points. Index performance was led by Discretionary and Communication Services, which benefited from a better growth outlook, offset by declines in Materials, Health Care, and REITs, due to a weaker China outlook and higher rates.

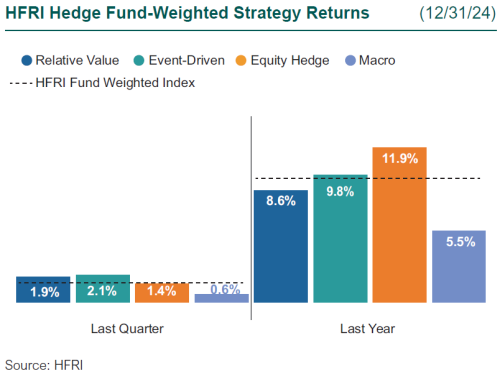

Hedge funds finished strong to end the year, and relative value strategies finished higher, as managers were able to profit off rising bond yields. Equity hedge strategies exhibited strong momentum, as managers profited on both the long and short side during the quarter as stock dispersion remained elevated. Event-driven managers soared in November, on the expectation of a strong M&A cycle in 2025. Macro strategies had a strong November, as managers were able to profit off rates moving higher in the final quarter of the year.

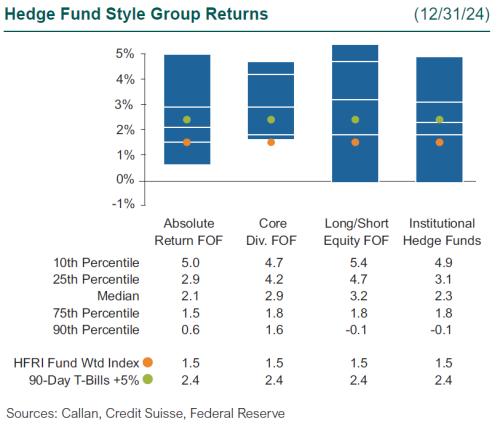

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 2.3%. Within this style group of 50 peers, the average hedge credit manager gained 2.5%, driven by interest rate volatility in November following the U.S. election. Meanwhile, the average hedge equity manager added 2.1%, as managers were able to profit off elevated dispersion across sectors.

Within the HFRI indices the best-performing strategy was event-driven, which was up 2.1% as current M&A deals reacted positively to the new administration. Relative value strategies ended up 1.9%, as managers were able to profit off interest rate volatility in the month of November. Equity hedge strategies closed up 1.4%, as managers were able to generate alpha both on the long and short side during the quarter. Macro strategies closed up 0.6%, as managers were positioned for rates to move up in November following the election.

Across the Callan Hedge FOF database, the median Callan Long-Short Equity FOF ended 3.2% higher, as managers were able to profit off the dispersion across sectors. Meanwhile, the median Callan Core Diverse FOF ended 2.9% higher, as equity hedge and event-driven strategies drove performance for the quarter. The Callan Absolute Return FOF ended 2.1% higher, as an overweight to relative value strategies drove performance.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

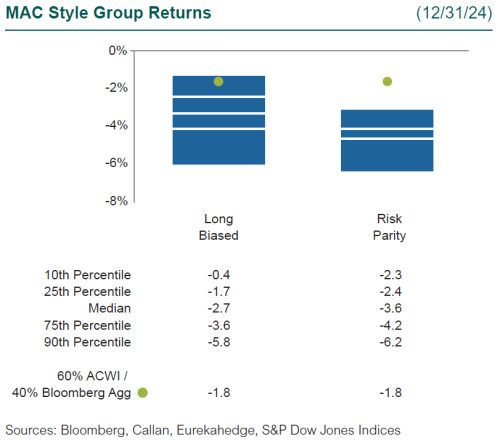

Within Callan’s database of liquid alternative solutions, the Callan MAC Risk Parity peer group fell 3.6%, as fixed income and commodities were a drag on performance, while U.S. equities were able to offset some of that negative performance. The Callan Long Biased MAC peer group fell 2.7%, as negative performance from fixed income pushed the strategy into negative territory.

After a strong run for hedge funds in 2024, the market environment outlook appears to be choppier in 2025. While economic growth remains strong and recession probabilities seem low, market expectations remain high, valuations are at all-time highs in equities, and spreads are tight in credit markets, leaving investors with limited margin for errors. With a new administration in the White House, change seems the most likely outcome, and uncertainty should be expected for market participants. In this environment, hedge funds should be able to profit off this dispersion.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.