Defined contribution (DC) plan sponsors will continue their sharp focus on fees, according to Callan’s 2022 Defined Contribution Trends Survey, but they also will be taking a close look at their investment policy statements and conducting formal fiduciary training in the coming year.

Our survey also found that recent legislative initiatives spurred sponsors to make several changes to their plans. The SECURE Act led 31% to say they will increase their automatic escalation rate and 13% to say they are very or somewhat likely to add an annuity option. And after the CARES Act established coronavirus-related distributions for qualified individuals, 35% of sponsors are now actively encouraging affected participants to make repayments.

Callan’s annual DC Trends Survey is designed to provide a benchmark for sponsors to evaluate their plans compared to peers, and to offer insights to help sponsors improve their plans and the outcomes for their participants.

Callan has published the DC Trends Survey since 2007. This year’s survey included responses from 101 plan sponsors, both Callan clients and other organizations; nearly 80% were corporate organizations. Of all respondents, 90% offered a 401(k) as their primary DC plan, and 74% had more than $1 billion in assets. Responses were collected in the fall of 2021.

Highlights of the Callan DC Survey

FEES: In 2021, plans took the following steps related to their fees, their top priority:

- Benchmarking: 83% benchmarked plan fees, with consultant databases the most commonly used method.

- Analysis: 33% of respondents reduced fees after their most recent fee analysis.

- All-in Fees: These encompass a variety of expenses, such as administration, participant transaction fees, compliance, custody, and communications. Nearly 7 in 10 respondents calculated these fees within the past 12 months.

- Payment: Investment management fees were most often paid entirely by participants (85%), and almost always at least partially by participants (92%). By contrast, 58% of all administrative fees were paid entirely by participants.

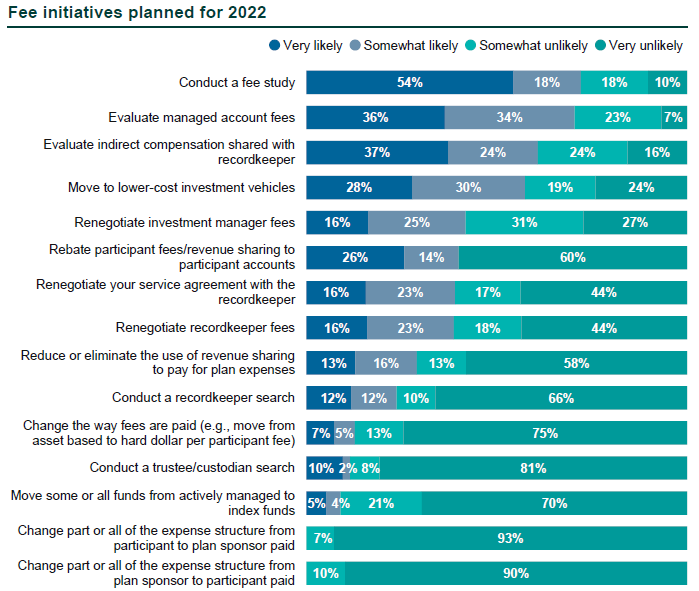

Fees are also the top priority for 2022, with plans focused on the following actions:

- 72% are somewhat or very likely to conduct a fee study.

- Nearly the same share also said they are somewhat or very likely to review other fee types.

- 58% of respondents are likely to move to lower-cost investment vehicles.

- Other somewhat or very likely actions include renegotiating:

- Investment manager fees (41%)

- Service agreements with recordkeepers (39%)

- Recordkeeper fees (39%)

TARGET DATE FUNDS: Nearly all plans offered a target date fund (TDF). Among those that did, 81% used an implementation that was at least partially indexed. The share of active-only strategies is now at its lowest point in survey history (19%). In 2021, 63% of plans took at least one action around their TDF. The most common were to evaluate the suitability of the glidepath (41%) and the suitability of the underlying funds (29%). A similar percentage of plans aim to evaluate the suitability of the glidepath in 2022.

DEFAULT INVESTMENT: Nearly every respondent had a qualified default investment alternative (QDIA) as the default investment fund, and 92% used a TDF as the default for non-participant directed monies, an all-time high.

INVESTMENT MENU: 91% of DC plans had a mix of active and passive investment funds. Purely active (1%) or passive (4%) remained a rarity.

INVESTMENT VEHICLES: Mutual funds (85%) and collective trusts (78%) continued to be the most prevalent investment vehicles.

INVESTMENT STRUCTURE: In a drop-off from past years, only 38% of plan sponsors conducted an investment structure evaluation within the past year, though 79% have done so within the past three years.

MANAGED ACCOUNTS: 71% of respondents that offered managed account services did not benchmark the outcomes of the services.

RECORDKEEPERS: 24% of sponsors plan to explore a recordkeeper search in the coming year, a notable increase from our previous survey (14%).

ADVISORY SERVICES: Up notably in recent years, all DC plan sponsors (100%) offered some form of investment guidance or advisory service to participants. Nearly all respondents offered general guidance (92%), while 80% offered seminars and 69% offered financial wellness tools.

FINANCIAL WELLNESS: 86% of employers offered financial wellness support. Of those employers that did not offer any financial wellness programs, 22% indicated they may do so in the near future.

PLAN LEAKAGE: 86% of sponsors took steps to prevent plan leakage. Top actions included offering partial distributions (66%) and installment payments (57%).

RETAINING ASSETS: 51% of plans had a policy regarding retaining the assets of terminated or retired participants; of those that did, 76% sought to retain the assets of both retirees and terminated participants, a notable increase from 2015 (44%).

PLAN SUCCESS: In line with the past three years, most sponsors used the participation rate to measure the success of their plan. Investment performance was the second-most-used criteria.

COMPANY MATCH: Only 12% of plan sponsors made a change to their company match in 2021. Of those that did, 29% reinstated the match while another 29% increased the match. In 2022, 16% plan to make a change to the match while another 8% may consider a change. Most plan to increase (40%) or restructure (40%) their match.

RETIREMENT INCOME: 85% of plans offered some sort of retirement income solution to employees in 2021. Partial distributions (82%) and installment payments (77%) were the most common solutions.

CONSULTANTS: Almost 9 in 10 sponsors engaged an investment consultant (retainer and/or project) in 2021, closely in line with both 2019 and 2020 (89%).

COMMUNICATION: Retirement readiness and increasing savings rates tied as the top areas of focus for plan communications.

Along with the data in our quarterly Callan DC Index™ and Target Date Index™, this survey paints a detailed picture of the challenges and opportunities that are top of mind for DC plan sponsors this year.