This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments. See all posts in the series here.

Discount Rate Trends

In last month’s note we spoke about issues in the U.S. banking system instigated by the failures of Silicon Valley Bank and Signature Bank, and potential concerns with other regional financial institutions. The issues arose as these banks invested short-term assets in mortgages and other debt instruments whose durations extended materially with the rapid increase in interest rates. This asset-liability mismatch was exacerbated by concentrated lending populations and client types. Despite these concerns, debt and credit markets were remarkably muted over April. The FOMC released its March notes mid-April, beginning with a comment that banking regulation and supervision will be further scrutinized but attempting to allay depositor fears by saying that the U.S. banking sector is “sound and resilient.”

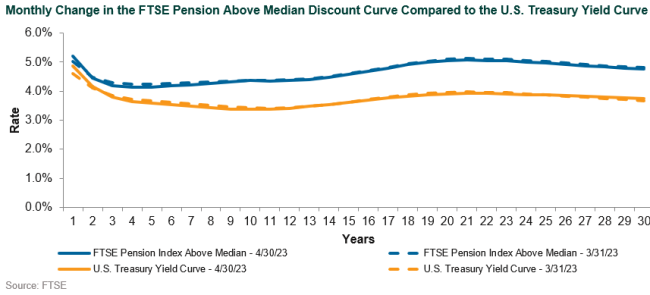

April Interest rates were range-bound, with the 10-year Treasury finishing the month 5 bps below where it started (+3.48%). The 10-year ranged between 3.27% and 3.58% during the month, settling in at 3.43% at month end. Long credit spreads, the other component of discount rate movements, hardly budged in April—starting the month at 159 bps over like-duration Treasuries and ending the month at 157 bps over. This contrasted with March, where fears of banking failure roiled the financial services sector, which bled over to other sectors during the month.

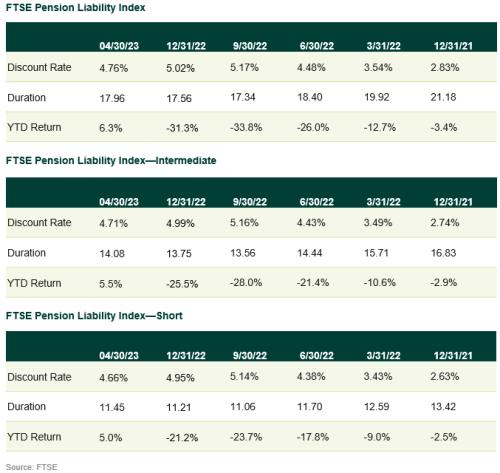

Pension Liability Index Detail

The FTSE Pension Liability Index, which is a proxy for changes in the discount rate, hardly changed month-over-month. The broad index tightened by 4 bps to end the month at 4.76%, while the Intermediate and Short Duration indices both tightened by 4 bps as well. In comparison to the beginning of the year, discount rates are slightly more than 25 bps tighter, but 55 bps wider than this time last year (4.76% in April 2023 vs. 4.21% in April 2022). Except for March, where spreads widened meaningfully on financial sector concerns, long credit spreads have remained relatively tight and the vast majority of the move in discount rates has been interest rate-related.

Impact of Higher Rates on the Pension Risk Transfer Market

Last year closed out as the largest year on record for premiums transferred to insurers. The market recorded approximately $52 billion in PRT premiums and was dominated by deals made in the second half, with at least one mega deal (IBM’s $16 billion pension risk transfer) announced in 3Q22. Callan has published a fair amount on the subject, taking a somewhat contrarian view to the consulting community’s push toward retiree buy-outs and plan termination. In large part, everyone agrees that plans started 2023 in a better funded position than they started 2022 or 2021. The swift reversal in interest rates in 2022 generally shrank liabilities more than assets, and as a result funded ratios rose. At higher interest rates, terminating the cheapest portion of a plan (retirees) appears attractive, especially for those plans whose pension liabilities comprise a meaningful portion of a company’s balance sheet. Expectations for 2023 vary, however, with reports that 2023 is shaping up to be even larger than 2022, according to Legal & General, as well as outlooks stating that while higher rates and funded status makes transferring liabilities attractive, the large market transactions from 2022 are not guaranteed or anticipated, according to Aon.

What Callan has noticed, among its corporate DB clients, is that there is interest in managing the asset pool for the foreseeable future as well as looking for ways to reduce and manage the liability. Our expectation is that the transaction count will remain elevated yet with smaller deals, and that 2023 will be focused on managing surplus. How to manage surplus, and finding ways to use the surplus without triggering excise tax is a topic for another day, but one we’d love to explore with you.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.