Concentrating on equity concentration

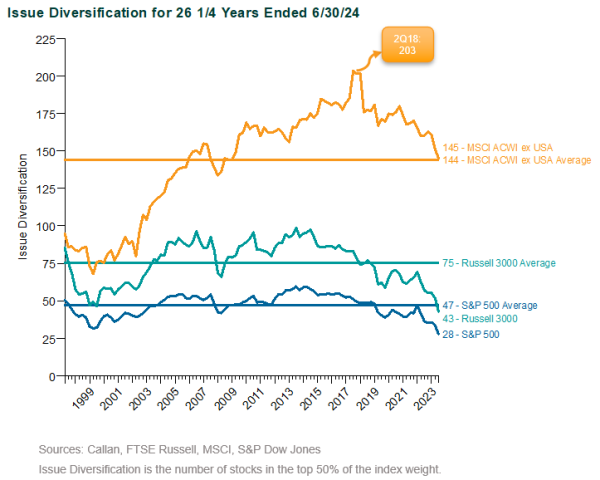

While both the S&P 500 and Russell 3000 Indices are near their most concentrated levels since 1999, the global ex-U.S. equity market has a broader opportunity set and a rising number of listed companies. In fact, the MSCI ACWI ex USA Index is currently more diversified than its historical average.

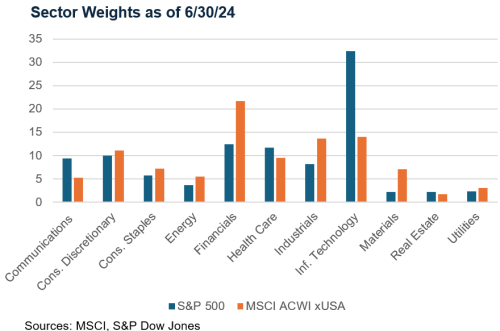

As of 6/30/24, the largest sector in the S&P 500 accounted for 32% of the index’s weight, while only 22% in the MSCI ACWI ex USA Index. It is important to note that the U.S. equity market has also become more growth-oriented while global ex-U.S. has become more value-oriented:

- The S&P 500 is more dominated by growth-biased sectors (e.g., Information Technology and Health Care).

- The MSCI ACWI ex USA Index has larger representations in value-biased sectors (e.g., Financials, Industrials).

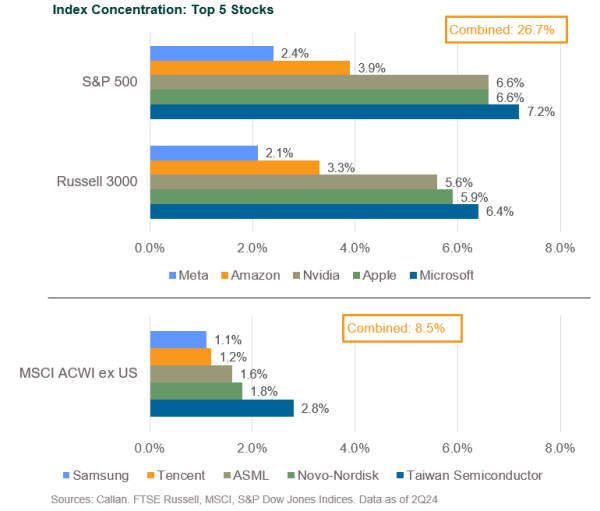

Unlike the U.S., where the weight of the top five stocks in the S&P 500 Index was 26.7% at the end of 2Q24, the weight of the top five constituents of the MSCI ACWI ex USA Index was only 8.5%. The single largest holding in the S&P 500 represents 7.2% vs. 2.8% in ACWI ex USA. The weight of the single largest stock in the S&P 500 (Microsoft) is roughly the same as the combined weight of the top four stocks in the MSCI ACWI ex USA.

What Have We Seen Among Active Managers?

When benchmarking against a concentrated index, managers seeking to outperform often concentrate their holdings even more, thereby taking on higher active risk. Given the nature of the current market environment, active managers’ focus has been on confirming sound stock selection to stay committed to their investments throughout the noise of short-term benchmark comparisons. They are also hopeful that their clients are patient and have long enough time horizons to allow their active strategies to shine.

What Should Investors Do to Diversify?

Considering the heavy concentration within the U.S. market in a small number of large-cap growth stocks, global ex-U.S. equity (as well as U.S. value and U.S. small cap) could serve as a potential diversifier within a global equity structure.

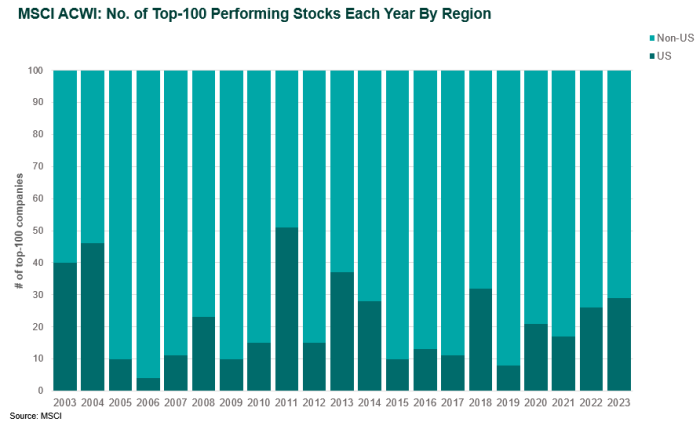

Over the last 20 years, the average number of global ex-U.S. companies in the list of the top 100 performing stocks globally is 78—versus 22 in the U.S. And that outperformance is more diversified. In the U.S., the top three outperforming sectors are generally Technology, Health Care, and Consumer Discretionary. In global ex-U.S. markets, the top three outperforming sectors rotate from year to year, meaning there is more diversified leadership across sectors.

Additionally, the number of listed stocks in the global ex-U.S. market is also significantly larger than what is available in the United States. This contributes to investment opportunities, particularly in inefficient areas of the market such as global ex-U.S. small cap and emerging market equity. The addition of this expanded opportunity set can provide diversification and return potential.

As the outperformance of the Technology sector continues to drive U.S. equity performance (and as a result, makes U.S. equities a larger and larger share of global indices such as MSCI ACWI), looking outside the U.S. for investment opportunities may be a valuable exercise for institutional investors seeking to diversify their global equity portfolios.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.