Highlights from the Global Markets in 2Q24

Stocks generally gained but showed wide dispersion: by size, sector, and region. The Magnificent Seven and its global equivalent continued to drive gains. Fixed income indices were flat, or very close, in the quarter, with the Bloomberg US Aggregate Bond Index showing a loss for the year. Treasury yields rose.

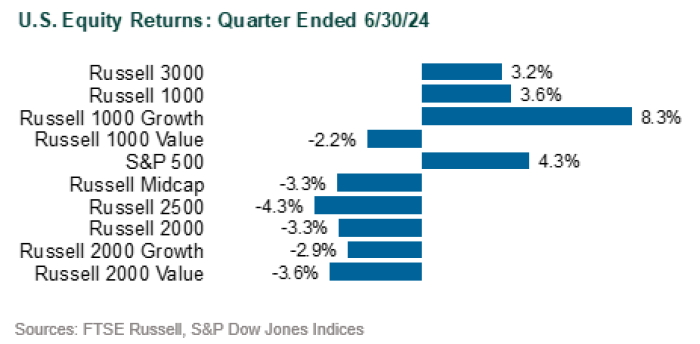

U.S. Equity: The S&P 500 Index hit 31 record highs over the first six months of 2024 and gained 15.3%. Second quarter results (+4.3%) were very mixed with sector performance ranging from -4.5% (Materials) to Technology (+13.8%) with 6 of the 11 S&P 500 sectors posting negative 2Q returns.

Index returns were driven by a handful of stocks; the 10 largest stocks in the index returned 14% while the equal-weighted S&P 500 fell 2.6% for the quarter. Value (Russell 1000 Value: -2.2%) sharply underperformed Growth (Russell 1000 Growth: +8.3%) and small cap (Russell 2000: -3.3%) underperformed large (Russell 1000: +3.6%).

The Magnificent Seven comprised 33% of the S&P 500 as of quarter-end and, as a group, they climbed 33% in the first six months of the year, far exceeding the “S&P 500 ex-Mag Seven” gain of only 5%. However, there was much dispersion within this group as noted by the worst YTD return (Tesla: -20%) vs. the highest (NVIDIA: +150%).

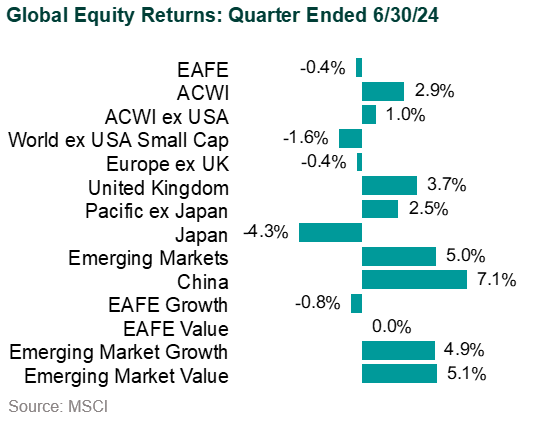

Global Equity: The MSCI ACWI return (+2.9%) was attributable to only five stocks (NVIDIA, Apple, Alphabet, Microsoft, and Taiwan Semiconductor), four of which are U.S. companies. The remaining 9,000-plus stocks were down 0.1%. The MSCI ACWI ex-USA eked out only a modest gain of +1.0%. France (-7.5%) was a notable underperformer given concerns over the advancement of the far right and implications for spending and increases in an already high deficit. Japan (-4.3%) was a notable underperformer but in local terms the country was up 1.8%. The yen fell about 6% in 2Q to its weakest level since 1986. The currency is down 12.4% YTD.

Emerging markets (MSCI EM: +5.0%; Local: +6.2%) also saw mixed results. Latin America (-12.2%) fared the worst driven by poor returns in Brazil (-12.2%) and Mexico (-16.1%). Meanwhile, Emerging Asia (+7.4%) benefited from strong performance in China (+7.1%) and Taiwan (+15.1%). India (+10.2%) was also up sharply for the quarter in spite of a short-lived sell-off after the election.

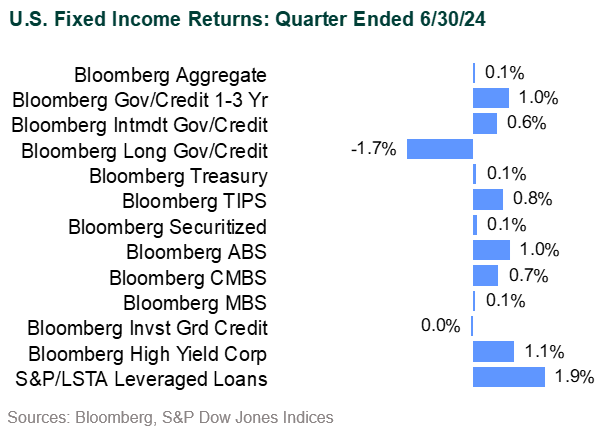

U.S. Fixed Income: The Bloomberg US Aggregate Bond Index (+0.1%) was flat in 2Q, bringing its YTD return to -0.7%. The yield on the 10-year U.S. Treasury climbed from 4.20% to 4.36% over the quarter. Mortgages were the only sector to underperform U.S. Treasuries on a duration-adjusted basis. High yield (Bloomberg High Yield: +1.1%) and bank loans (Morningstar Leveraged Loan: +1.9%) were top performers for the broader market. Valuations, as measured by spreads, remained rich from a historical perspective across the credit spectrum as absolute yields attracted buyers less interested in relative value. Supply was robust but met with strong demand.

Municipal Fixed Income: Municipal bond returns (Bloomberg Municipal: 0.0%) were also muted in 2Q. Yields rose most sharply in five- and seven-year maturities (44 bps), causing intermediate indices to underperform the broad market. The Bloomberg Muni 1–10 Year Index fell 0.4% for the quarter. Lower-rated bonds outperformed (AAA: -0.3%; BBB: +0.7%). Issuance in 2024 is more than 40% ahead of last year and the strongest in at least a decade but has been met with strong demand.

Global Fixed Income: Global bond returns were also flat (Bloomberg Global Aggregate USD Hedged: +0.1%) while dollar strength eroded returns in unhedged terms (Bloomberg Global Aggregate Unhedged: -1.1%). Emerging market performance was similarly uninspiring with the hard currency JPM EMBI Global Diversified Index up 0.3% and the local currency JPM GBI EM Global Diversified Index down 1.6%. Brazil (-10.7%) and Mexico (-9.6%) were notable underperformers in the latter given currency weakness.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.