Listen to This Blog Post

The multi-family housing market is navigating a complex landscape shaped by numerous economic and demographic factors. While demand for rental housing remains robust, the sector faces challenges such as elevated interest rates, supply chain disruptions, and regulatory uncertainties. These issues have contributed to a slowdown in new multi-family construction, with construction starts and deliveries falling meaningfully. But markets with limited supply are experiencing positive rent growth, underscoring the resilience of the sector in certain regions.

Apartment Supply Trends: Expected to Decline

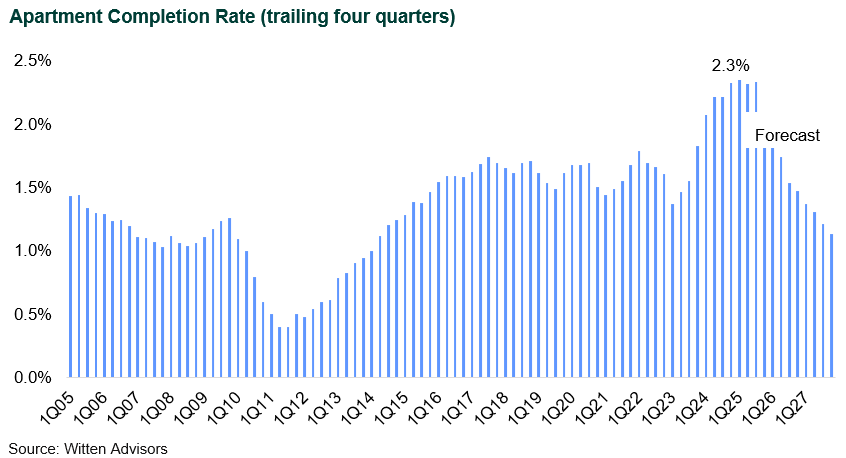

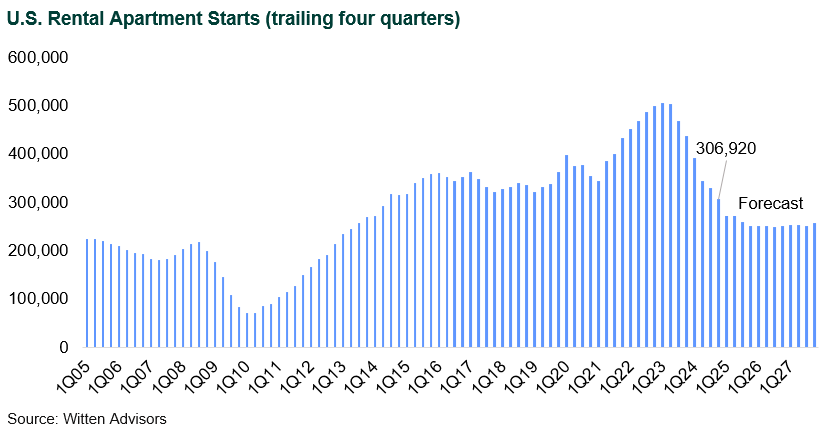

Apartment completions (new apartments finished and ready for occupancy) as a percentage of total stock hovered between 1.0% and 1.5% leading up to the Global Financial Crisis (GFC), then plummeted. It took nearly five years for completions to recover before remaining relatively stable from 2017 through early 2022, albeit with some bumps caused by the pandemic. Completions are now at elevated levels, peaking at 2.3% at year-end 2024 due to the large number of projects started during the post-pandemic construction boom. After 2025, completions are expected to decline toward historical norms because of higher interest rates and tighter lending conditions.

The forecast for lower completions is supported by the trend of declining U.S. apartment starts that began in late-2023. Given continued headwinds for development, including elevated materials and labor costs, the forecast for apartment starts is depressed through 2027.

Apartment Demand Trends: A Decline in the Forecast

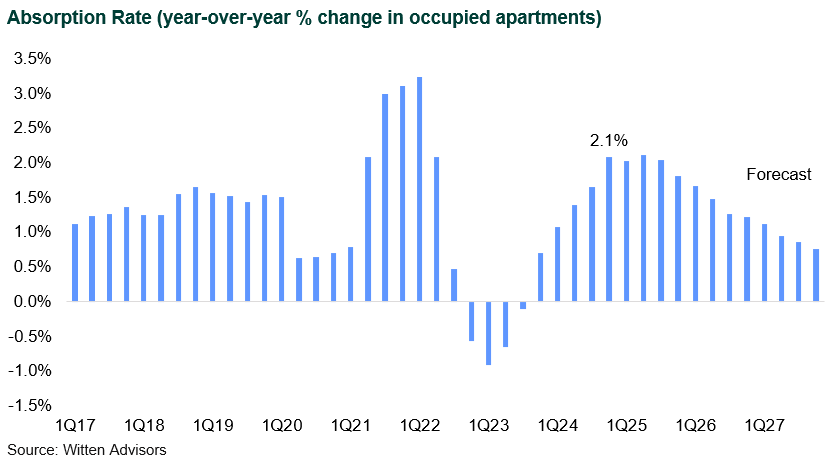

Apartment absorption rates (net change in apartments rented) were stable from 2017-19, generally hovering around 1.0% year-over-year growth in occupied units. However, demand surged in 2021, with absorption rates peaking above 3.0% due to strong household formation, increased migration, and pent-up demand following the pandemic. This spike was driven by low interest rates, remote work trends, and a strong economic recovery. However, absorption rates declined sharply in 2022, even turning negative at some points, in the wake of the pandemic.

Absorption rates are now at 2.1%. This recovery aligns with continued population growth, a resilient labor market, and the necessity-driven nature of housing demand. However, absorption remains moderate due to high rental costs and affordability challenges, which have slowed new household formations.

Absorption is expected to gradually decline for the next several years. This trajectory suggests demand will stay healthy but not strong enough to fully counterbalance the elevated level of new completions. Over time, as completions decline and the supply pipeline shrinks, absorption rates may stabilize closer to long-term averages.

Vacancy Rate Trends: Heading Back to Normal

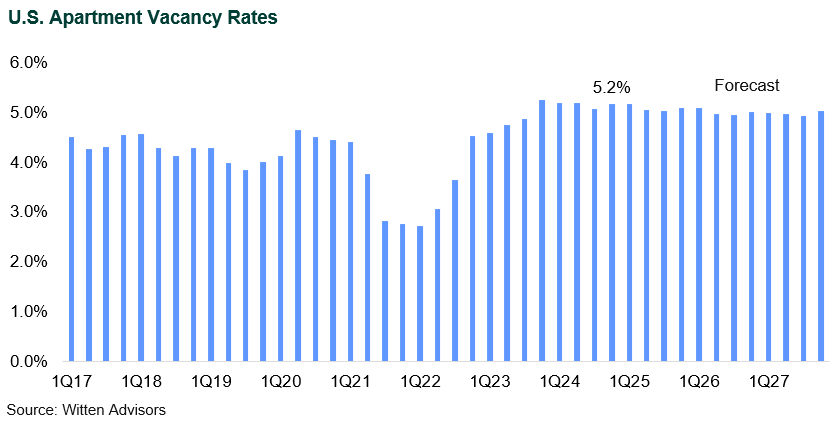

From 2017-21, the U.S. apartment sector experienced a relatively consistent vacancy rate in the mid-4% range. The vacancy rate began to decline in 2021 following the pandemic, a period marked by an increase in household formation, which led to declining vacancy rates and rising rents. Apartment developers responded to rising demand by substantially increasing construction. This new supply put upward pressure on vacancy rates, which increased to 5.2% by year-end 2024.

Cap Rate Trends: Major Fluctuations

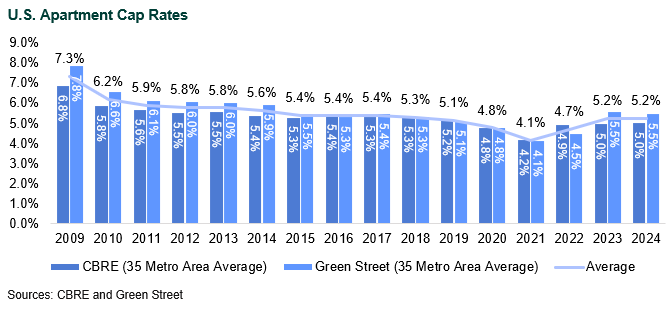

Over the past 15 years, U.S. apartment capitalization rates (or cap rates, defined as the ratio of net operating income to property value) have exhibited significant fluctuations, reflecting broader economic cycles and shifts in the real estate market. In the aftermath of the GFC, cap rates were elevated due to heightened risk perceptions and tighter credit conditions. As the economy recovered in the subsequent decade, increased investor confidence and abundant capital led to a compression of cap rates, reaching historic lows in 2021, driven by low interest rates, strong rental demand, and favorable demographic trends.

Since 2021, cap rates have experienced a notable upward trend coinciding with U.S. interest rate hikes. Based on data from CBRE and Green Street, cap rates averaged 4.1% in 2021 before increasing to 5.2% by 2024. This rise reflects broader market shifts, including higher interest rates, evolving investor sentiment, and potential adjustments in property valuations. The increase suggests a recalibration in pricing expectations as market conditions continue to evolve.

CBRE’s 2025 market outlook anticipates a slight decline in multi-family cap rates, projecting a decrease of 17 basis points from their 2024 peaks. However, more conservative forecasts project that cap rates will remain flat in the near term, as higher-for-longer interest rates and economic uncertainty continue to weigh on the market. In a bear case, apartment cap rates could expand once again, driven by prolonged economic uncertainty, stubbornly high interest rates, and tighter lending conditions.

Given these uncertainties, a manager’s operational skillset and ability to drive net operating income (NOI) are critical. While cap rate movements impact valuations, an NOI-driven approach offers a more resilient path to value creation, ensuring sustainable long-term performance across market cycles rather than relying on cap rate compression.

Rent Growth Trends: After Spike and Tumble, a Recovery

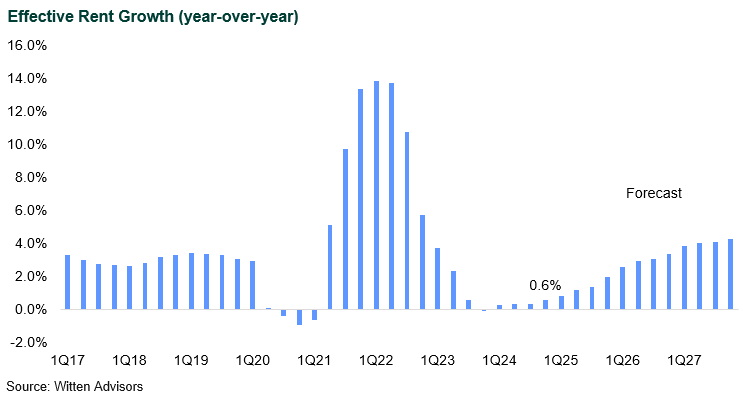

Effective rent growth remained steady between 2017 and 2019, averaging between 2% and 4% annually. However, rent growth spiked dramatically in 2021 and early 2022, peaking at over 14%, fueled by high demand, tight supply, and strong household formation. As affordability pressures mounted and absorption rates declined, rent growth quickly decelerated in late 2022 and 2023.

Rent growth is at subdued levels (0.6% in 4Q24) due to the high volume of apartment completions entering the market, which has increased competition among landlords and limited their pricing power. Additionally, broader economic uncertainty and stretched affordability have contributed to softer rent growth compared to the post-pandemic boom. Rent growth is expected to gradually recover, reaching around 4% by 2026, as supply slows and demand stabilizes. The decline in new completions post-2025 will help reduce competitive pressures, allowing landlords to regain some pricing power.

Discount to Replacement Cost: Owners’ Market

The multi-family real estate market presents opportunities to acquire assets below replacement costs, driven by rising cap rates and higher inflation. The expansion of cap rates has led to a decline in multi-family property values of greater than 20% from their 2022 peak. Simultaneously, inflation has escalated costs for materials, labor, and land, making new developments more financially challenging.

Consequently, existing property owners, having acquired assets at lower costs, can offer more competitive rental rates compared to new developments that require higher rents to cover increased construction expenses. This advantage allows current owners to maintain occupancy and attract tenants, while the slowdown in new development may lead to tighter housing supply in the future.

Regulatory Considerations for Multi-family Market

Expanding regulatory measures, including increased rent control policies and enhanced tenant protection laws, pose notable operational challenges. Rent control can restrict landlords’ flexibility in pricing rents according to market dynamics, potentially affecting revenue and profitability. Additional tenant protections, including eviction moratoriums and stringent eviction procedures, add layers of complexity in property management and operational practices.

Moreover, algorithmic pricing strategies have come under scrutiny, raising concerns about potential anti-competitive effects and uniform rent increases. Regulatory pushback from public officials and the Department of Justice underscores the importance of compliance and adaptability in management practices, potentially affecting operational efficiency and net operating income (NOI).

Insurance and Expense Trends

Insurance premiums, now comprising a significantly higher portion of total operating costs (increasing from 8% historically to 17%), reflect rising natural disaster risks, higher property replacement costs, and tightening insurance market conditions. Broader inflationary pressures, including increased maintenance costs, property taxes, and labor expenses, further squeeze operational margins and NOI.

Conclusion

The multi-family market is entering a period of transition, with both opportunities and challenges shaping its trajectory. While vacancy rates may level off and rent growth could see modest improvements in select markets, high supply levels and affordability concerns will likely temper gains. Investors remain watchful, balancing optimism with caution as regulatory risks, rising insurance costs, and expense growth create headwinds. At the same time, shifts in replacement costs and valuation trends could present new dynamics for market participants. Moving forward, careful navigation of these factors will be key to achieving stability in an ever-changing landscape.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.