Over the past 20 years, nonprofits have made broader use of alternative investments, which has had a huge impact on their portfolios. In more recent years, the adoption of private credit strategies as a tool for growth and diversification has been a topic of many boardroom discussions. And in the past year, the increase in interest rates has provided another avenue for return and diversification.

Of course, meeting the spending needs of the organization in a risk-controlled manner is the ultimate goal, with most nonprofits targeting a return near 7%. At this rate the organization can spend 5% (or less) and maintain the purchasing power of the portfolio in a normalized 2% inflation environment.

But there are many ways to get there. In this post I will address three long-term trends in nonprofit allocations:

- Shifts in the nature of portfolios

- Evolution of private credit and its role in nonprofit portfolios

- Impact on returns by the size of nonprofits

20 Years of Nonprofit Allocations

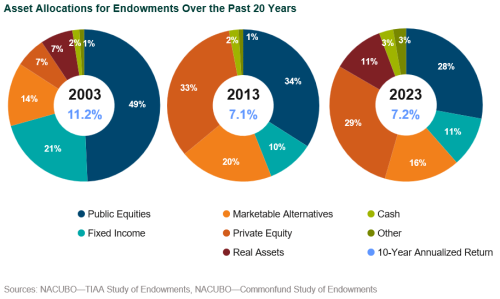

The chart below illustrates the shifts over time. The primary change is the reduction of the two most liquid asset classes, public equity and fixed income, from 70% of nonprofit portfolios in 2003 to 39% in 2023. These assets were shifted to marketable alternatives (hedge funds) and private equity from a total of 21% in 2003 to 45% in 2023.

One of the main side effects of this shift in allocations has been a reduction of liquidity in the portfolio. The real asset allocations are often illiquid, containing real estate as well as other real assets in a less liquid hedge fund or private structure. The inclusion of real assets in the “illiquid bucket” brings the total of illiquid investments to more than half of portfolios at 56%. This makes these portfolios less nimble and harder to rebalance during market moves. As we experienced during 2008, redemption pressure may be felt by the most liquid portions of the portfolio in times of market stress.

Development of Private Credit as an Option

In recent years with the changes in banking regulations coming out of the Global Financial Crisis, hedge funds and other private vehicles have been developed to lend to corporations previously served by the banking industry. These private credit funds are becoming a standard part of a diversified nonprofit portfolio.

Prior to the increase in interest rates, these funds were seen as a way to increase the expected return for a portfolio while maintaining some of the diversification benefits of a fixed income instrument. This reaching for return in a low-rate environment had the effect of increasing the illiquidity risk and market risk in portfolios due to the correlation of these instruments with equities in volatile markets.

Initially these allocations to private credit were sourced primarily from fixed income. As these allocations have grown and the risks are more thoroughly vetted, these allocations are sourced from hedge funds and private investments, maintaining the risk profile of the portfolio.

Private credit strategies are here to stay, and that is a good thing. Used properly, they can provide returns and a degree of diversification from the primary risk in everyone’s portfolio, equities.

Returns and Portfolio Size

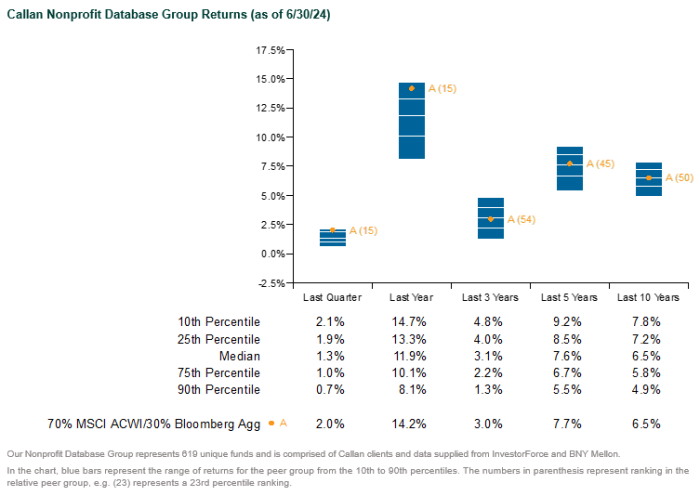

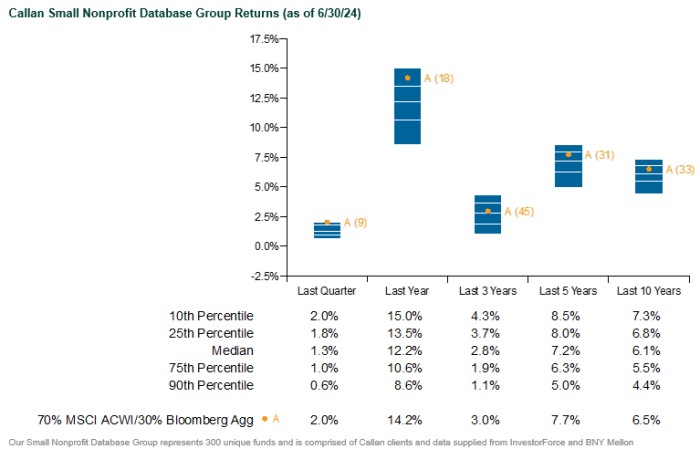

As the chart above shows, portfolios on average have met their return targets over the 20-year period ending June 2023. For more recent performance trends we look to the Callan Nonprofit Database Group. In the more granular recent data we see that the returns year to year have been more varied while still maintaining an annualized return near that 7% target.

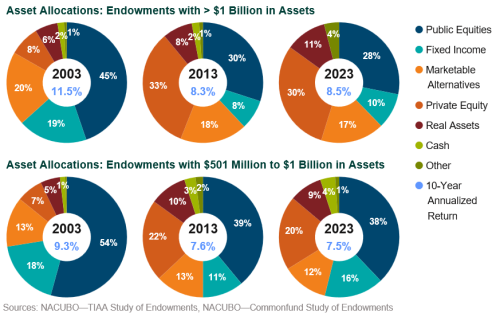

One aspect of asset allocation and performance that is worth looking at is the impact of the size of a portfolio. Over the past 20 years larger portfolios have been heavier users of less-liquid private equity and hedge funds. As of June 2023, portfolios with more than $1 billion in assets had a total allocation to these asset classes of 47% vs. 32% for portfolios between $500 million and $1 billion. There are multiple drivers of this difference, including the sophistication of the investment staff and board as well as the differing needs for liquidity.

This allocation difference has an impact on the risk and returns of the portfolios.

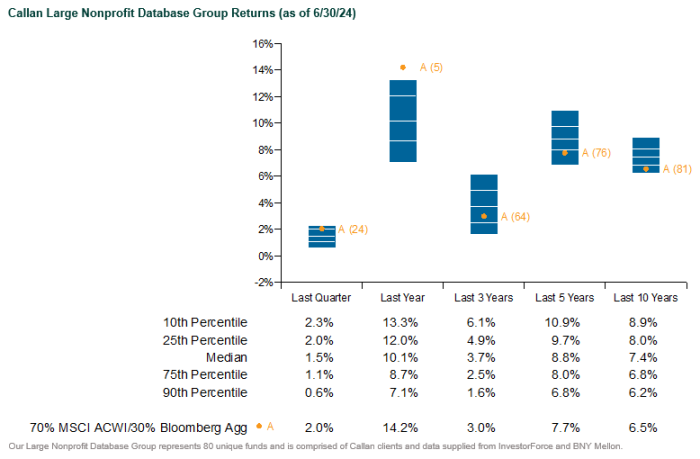

The charts below compare the performance of the largest portfolios (>$1 billion) to the smallest portfolios (<$100 million). Here we see the impact of the investments in hedge funds and private equity. The larger portfolios outperformed the smaller portfolios in the last quarter, 3-, 5-, and 10-year periods.

Conclusion

Allocations have changed over time as investment options have evolved with changing regulations and different market environments. The goal of providing appropriate risk-adjusted returns to support the organization has not. We have evolved out of a near-zero interest rate environment in the near term. This has provided an opportunity for nonprofit portfolios to reevaluate the role of fixed income in a portfolio, from just a risk-control asset to a return driver and a risk-control asset. The path of rates from here will impact how allocations change over the long term. No matter what the market environment, thoughtful asset allocation and rigorous due diligence in manager selection will never go out of style.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.