In 2017, U.S. equity assets appreciated for the ninth straight year: The tax reform legislation passed by Congress fueled positive sentiment about future economic fundamentals, while the markets shrugged off Fed rate hikes.

In the private equity market, company investments and exits trended strongly up during the year for buyouts, with venture capital slowing; however, the absolute level of activity stayed high.

Among the highlights of the year, according to industry data:

- Private equity fundraising neared the peak year of 2007’s $373 billion.

- Annual fund formation topped 1,000 for the first time.

- Apollo Investment Fund IX raised $24.7 billion, a record for a private equity fund.

- Announced dollar volume for buyout deals hit a nine-year high.

- Buyout initial public offerings (IPOs) numbered 18, more than double the eight in 2016.

- Venture capital fund commitments dipped 18% from 2016’s total.

- Information Technology received the largest amount of VC funding during the year by industry sector.

As measured by the Thomson Reuters/Cambridge Private Equity Database, private equity returns stayed positive over the year (+3.9%, +5.0%, and +4.2% for the first three quarters). The fourth-quarter return is expected to be up slightly, even with the year-end public market down-draft; the S&P gained 6.6% for the quarter.

With continued strong fundraising, a high-price environment, and fundraising outpacing company investment rates, 2018 faces the same challenges as the prior four years. The public market volatility that began in December and continued in early 2018 will likely have an impact on private market investment and exit volumes. We continue to expect a frothy fundraising environment. Plan sponsor support of the private equity strategy—notwithstanding high price-related general market concerns—continues to be strong.

Highlights of 2017 and the 4th Quarter

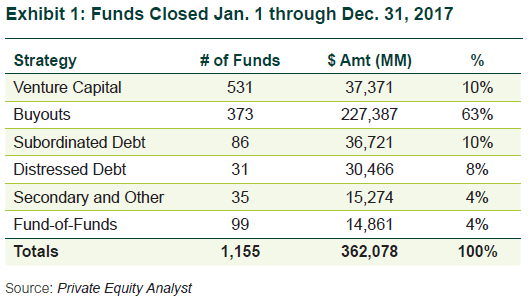

Fundraising: U.S. private equity funds raised $362 billion in 2017, a 10% increase over 2016’s $328 billion and only 3% away from 2007’s historical peak of $373 billion. The fourth quarter boosted the year’s total commitments, producing nearly a third of the year’s total, with 316 new funds created.

During 2017, 1,155 partnerships were formed, up 21% over the previous year’s 958, according to Private Equity Analyst. This is the first time annual fund formation has crossed the 1,000 mark.

The largest U.S. private equity funds that closed during the year, according to Private Equity Analyst:

- Apollo Investment Fund IX: $24.7 billion

- Silver Lake Partners V: $15.0 billion

- KKR Americas Fund XII: $13.9 billion

Buyouts: Fundraising (including Distressed) totaled $258 billion for the year, with 404 funds formed, according to Private Equity Analyst. This represents a 19% increase in commitment volume and a 16% rise in funds formed from 2016.

According to Buyouts newsletter, there were 1,649 deals in 2017, an increase of 25% from 2016. The year’s disclosed dollar volume was $184.2 billion, up 8% from 2016, reaching a nine-year high.

Buyouts reports that the number of M&A exits increased 9%, to 607 in 2017 from 557 in 2016. Announced dollar volume rose 12% to $107 billion from $95 billion last year.

The full year produced 18 IPOs raising a total of $6.5 billion—more than double the eight IPOs that raised $4.1 billion in 2016. The largest IPO in 2017 was Invitation Homes, which raised $1.8 billion in the first quarter.

Venture Capital: VC fund commitments in 2017 dipped 18% from 2016’s total, but 17% more venture funds were formed.

The number of venture capital rounds closed in 2017 totaled 8,076, down 6% from 2016, according to the National Venture Capital Association (NVCA). Announced dollar volume totaled $84 billion, up 16% from 2016.

Venture-backed M&A exits for the year totaled 771, down 13% from 2016, with announced values of $51 billion, down 4% from 2016. The quarter had 144 exits with announced values totaling $7 billion, compared to 173 and $12 billion in the third quarter.

The year produced 58 venture-backed IPOs raising $10 billion, up from the 41 IPOs in 2016 that raised $3 billion. The fourth quarter produced 23 venture-backed IPO exits raising a total of $3 billion.