Institutional investors evaluating the performance of their private real estate investments in the current interest rate environment may find it challenging to make sense of asset value declines and negative quarterly returns. After all, investors are coming off record-breaking performance in 2021 and the first half of 2022, and to a certain extent, fundamentals across most private real estate sectors—with the primary exception of traditional office—remain favorable. But the Federal Reserve’s aggressive interest rate hikes throughout 2022 have led to a significant repricing across most asset classes, not just real estate. Publicly traded real estate investment trusts (REITs) have already experienced this correction; not unsurprisingly, the pain is beginning to be felt in private real estate values.

How Higher Interest Rates Impact Private Real Estate

Higher interest rates impact private real estate in two primary ways, both of which result in downward pressure on real estate values:

- A higher cost of capital makes it more expensive for a buyer to finance an acquisition, resulting in lower price expectations in both appraised values as well as transaction values.

- A higher risk-free rate—as measured by the 10-year U.S. Treasury yield—means that a rational investor will require a higher yield from a real estate investment to compensate for the additional risk of investing in real estate vs. Treasuries (i.e., a risk premium). The required rate of return—expressed as a cap (for capitalization) rate—increases, which puts downward pressure on real estate values as shown in this cap rate formula.

Cap Rate = Net Operating Income / Value

Under this backdrop, real estate appraisers are applying revised assumptions to their valuation models, resulting in declining asset values and negative quarterly returns as depreciation outweighs the income return. Appraisers have increased discount rate and exit cap rate assumptions in their discounted cash flow models (also known as the income approach) to reflect the impact of higher interest rates on real estate values.

Appraisers also rely on market comparisons (i.e., actual transactions of comparable assets) to value real estate, another valuation method known as the comparison approach. However, the transactions markets have stalled significantly since the Fed began aggressively raising interest rates. Buyers now facing a higher cost of capital are demanding price concessions to transact so that they can generate the same levered returns as they could prior to the interest rate hikes. Sellers, on the other hand, have so far been unwilling to capitulate to these demands as they are under little pressure to sell due to distress or overleverage. Fewer transactions are taking place as a result, making it harder to determine asset pricing.

The four main property sectors are affected by this dynamic in different ways:

- In apartments, where capitalization rates have compressed significantly over the past several years, asset values are facing downward pressure primarily due to the impact of higher interest rates. While net operating income (NOI) growth was previously strong enough to offset changes in appraisal assumptions due to higher interest rates, fundamentals have softened in the apartment sector as the uncertainty of the economic environment has driven a slowdown in household formation. This lower NOI growth is unlikely to offset higher discount and exit cap rates going forward, and investors should expect apartment values to be written down in the coming quarters.

- In industrial, which also experienced cap rate compression in the pandemic recovery of 2021 and early 2022, fundamentals have also softened but to a lesser degree than they have for apartments. Nonetheless, NOI growth is no longer sufficient to offset increasing discount rates and exit capitalization rates. As a result, investors should expect negative quarterly returns in industrial for the first time since 2009.

- In retail, the outlook is more favorable than it is in apartments and industrial for the first time in over five years. Because the retail sector experienced somewhat of a re-pricing in the late-2010s, and cap rates did not compress nearly to the levels of other sectors post-COVID, retail real estate values are expected to fall less than other sectors. While value declines are still expected, the Pension Real Estate Association Consensus Forecast for 4Q22 indicated that real estate investment managers expect retail to be the top-performing sector in 2023.

- In office, real estate values are under pressure primarily due to a reduction in demand for office space in a post-pandemic world. The widely held expectation that tenants will require less office space in the future is driving depreciation in the office sector, which has the most uncertainty of the four major property sectors going forward.

Predictably, open-end private real estate funds have seen an increase in redemption requests as a result of the broader value declines in liquid asset classes. Suddenly, many institutional investors became overallocated to real estate as their public equity and fixed income portfolios fell but their real estate portfolio did not reset, a phenomenon known as the denominator effect. Some investors have sought partial redemptions from open-end real estate funds to rebalance their portfolios, while others are taking a wait-and-see approach as private valuations reset. Outstanding redemption requests for major funds in the NCREIF ODCE Index currently range from approximately 8%-16% of net asset value, with some notable outliers.

Redemption queues can be concerning when they are indicative of investors’ lack of confidence in an open-end real estate fund; however, Callan observes that many, but not all, redemption queues in the ODCE are reflective of the broader market environment, and—while they should be monitored closely—do not warrant overreaction. Real estate fundamentals (outside of traditional office) have generally remained strong coupled with more disciplined usage of debt following the GFC. The current re-pricing is being driven by the rapid change in financial markets rather than a reduced interest in real estate overall.

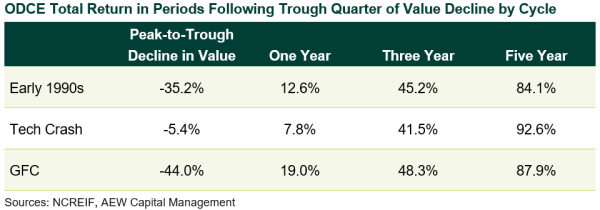

Based on what we observed from heightened redemption queues in prior economic downturns such as the GFC and the COVID-19 pandemic, we expect that some of these redemption requests will be rescinded once private valuations reset and we reach a period of greater economic certainty that supports improved real estate fundamentals and values. In fact, in prior cycles, the ODCE total returns following the trough value decline have been very strong.

Institutional investors should expect a re-pricing of real estate assets in the near term after two years of exceptionally strong performance. We remain optimistic about the longer-term performance of private real estate and note that in times of uncertainty there is also opportunity. Patient and disciplined investors may find attractive opportunities to acquire quality assets in favorable sectors and locations from motivated sellers, which may include building owners encumbered by debt maturities, open-end funds or separate account investors facing liquidity constraints, closed-end funds at the end of their lives with orphaned assets, and developers unable to refinance construction loans or simply looking to move recently delivered assets.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.