Listen to This Blog Post

I recently prepared Callan’s 2024 Real Assets Open-End Funds Fees and Terms Study, our inaugural look at these private markets vehicles.

The study included 144 funds, representing offerings across real estate, infrastructure, farmland, and timberland. Of the funds in the study, 77% were real estate funds, and the majority of those were equity funds. Infrastructure funds, at 14% of the data set, were the second-most prevalent. By strategy type, the funds were roughly evenly split between core, core plus, debt, and residential, with a smattering of value-add and industrial funds.

My study focused on four key principal terms:

- Management fees

- Performance fees

- Preferred return

- Redemption policies

The full study is available at the link above; this blog post summarizes its key findings.

Highlights of the 2024 Real Assets Fees and Terms Study

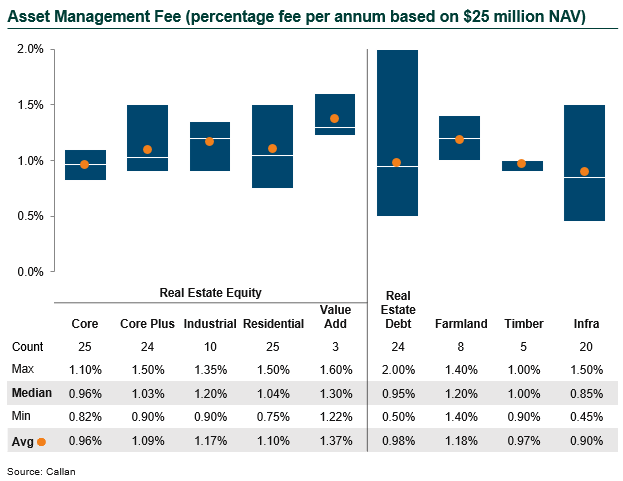

- Management fees for open-end funds are typically based on net asset value (NAV). Based on a $25 million NAV, core real estate equity funds had a median management fee of 96 bps, among the lowest in the study. Value-add funds had the highest fees, at 130 bps, although the sample size was small.

- The prevalence of performance fees varied by strategy. Only 38% of the funds in the study charged a performance fee. Of funds that charge a performance fee, European waterfalls were by far the most common (84%).

- Across all fund types, performance fees ranged from 0% to 20%, with the median fee typically either 10% or 15%, and there is some correlation between funds without performance fees and higher management fees.

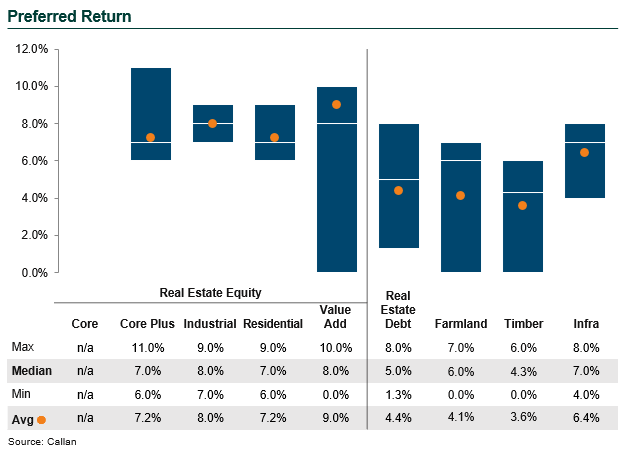

- The median preferred return across all strategies charging a performance fee was 7%. (Core real estate equity funds were excluded, as only four funds have performance fees.)

- Redemption policies have several nuances to consider. Investors have the ability to request redemptions, typically on a quarterly basis subject to liquidity. For core real estate funds, the redemption notice period can vary significantly, with some requiring 30 days’ notice and others requiring 90 days. For most other types of real estate funds, notice periods were considerably longer, most commonly 90 days.

- Redemption queues are instituted when a fund is unable to satisfy all redemption requests during a given quarter and must queue the balance to be paid in future quarters. One key consideration for investors and managers is how that queue functions. The two main methodologies are pro rata based on NAV and pro rata based on outstanding redemption requests. It is far more common for redemption queues to be based on NAV.

This study, which will be updated in future years, is intended to help institutional investors better evaluate open-end real assets funds, serving as an industry benchmark when comparing a fund’s terms to its peers. This study can also be useful for real assets investment managers, to determine how their fees and terms compare to other funds.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.