Large public defined benefit (DB) plans have found it very difficult to keep investment risk from rising without sacrificing expected returns. Some plans have maintained relatively higher levels of expected return, but may find their portfolios are relatively less diversified and less liquid than peers.

Risk-Return Tradeoff: Key Elements

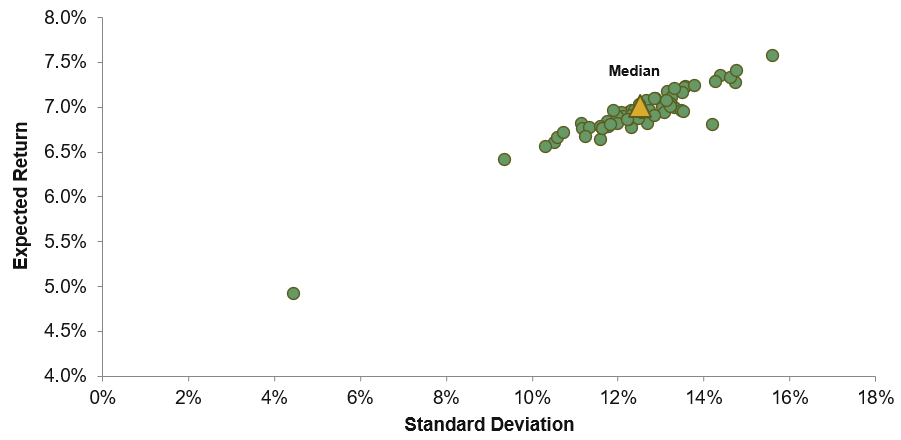

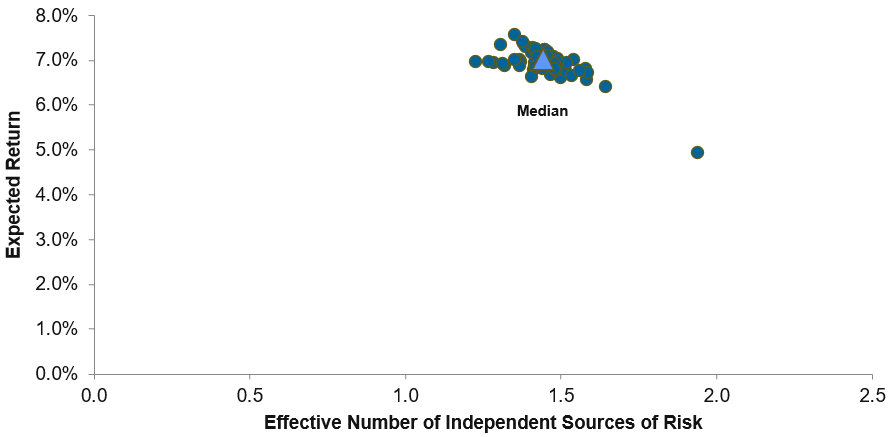

Institutional investors are of course well aware of the tradeoff that higher expected returns come with higher risk. This is evident across a peer group of large public DB plans (>$1 billion) compiled by Callan and analyzed with Callan’s 10-Year Capital Markets Assumptions. (In this and subsequent charts, the median plan is defined as the plan exhibiting approximately the median expected return and median standard deviation within the peer group.)

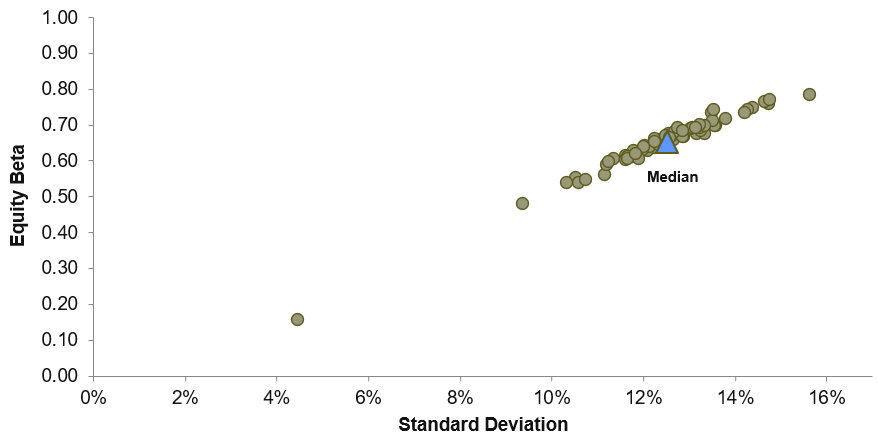

How do public plans take additional risk in pursuit of those higher returns? This is associated with adding Equity Beta into the portfolio. Equity Beta is a useful metric because it captures direct equity exposure, as well as “hidden” or indirect exposure that could be embedded in other asset classes.

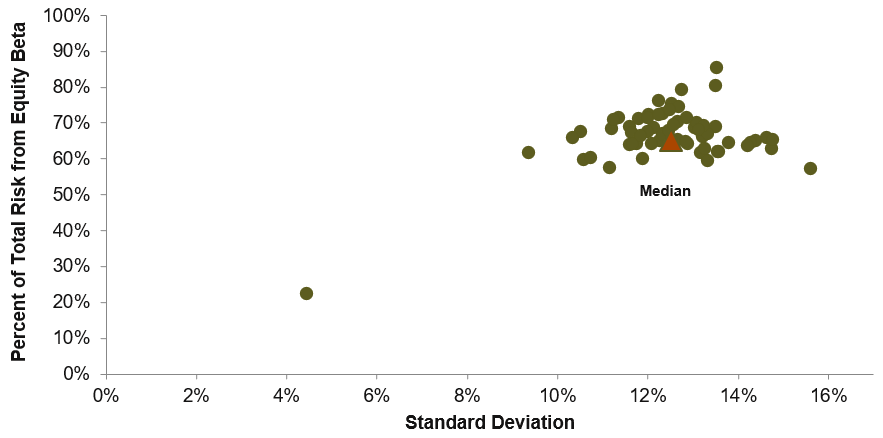

Consequently, public plans typically have about two-thirds of all their risk attributable to Equity Beta, a single factor.

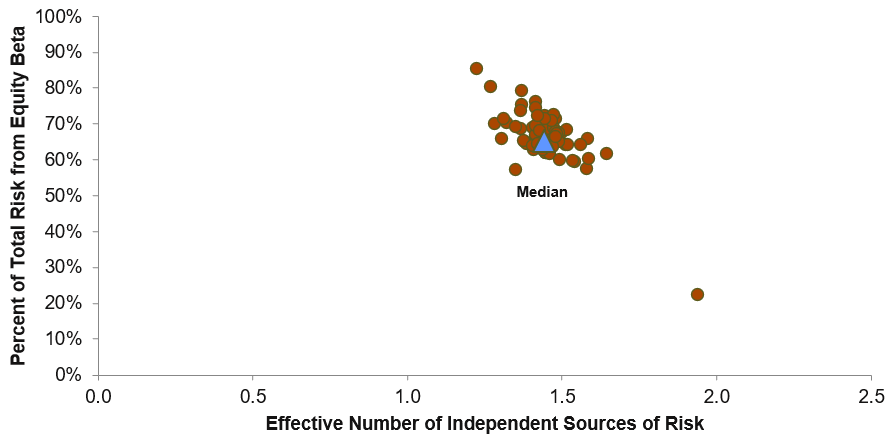

And this is associated with reduced levels of diversification. The level of diversification is quantified using Callan’s 10-Year Capital Markets Assumptions with a metric called the effective number of independent sources of risk.

While many public plans turn to alternative asset classes to simultaneously bolster both expected return and diversification, it’s necessary to be aware of potential illiquidity. Public plans pushing for higher expected returns without increased levels of illiquidity may see reduced diversification levels. Other plans have pursued meaningfully higher expected returns by increasing allocations to illiquid alternatives, primarily private equity, which has the highest expected return of any asset class.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.