Listen to This Blog Post

In my recent white paper, available at the link above, I explored the role of private equity secondary investments in institutional portfolios, analyzing their risk-return trade-offs compared to primary private equity funds. This blog post summarizes that work.

Secondary investments involve acquiring interests in already established private equity funds, offering benefits such as diversification, shorter duration, and faster capital distribution. However, they typically yield lower long-term returns than primary partnerships.

The secondary market has grown significantly, with fundraising reaching $100 billion in 2024, up from $22 billion in 2014. This expansion reflects increasing investor interest in liquidity management.

Structural Differences Between Primary and Secondary Investments

Primary and secondary private equity funds differ in cash flow timing and risk-return profiles.

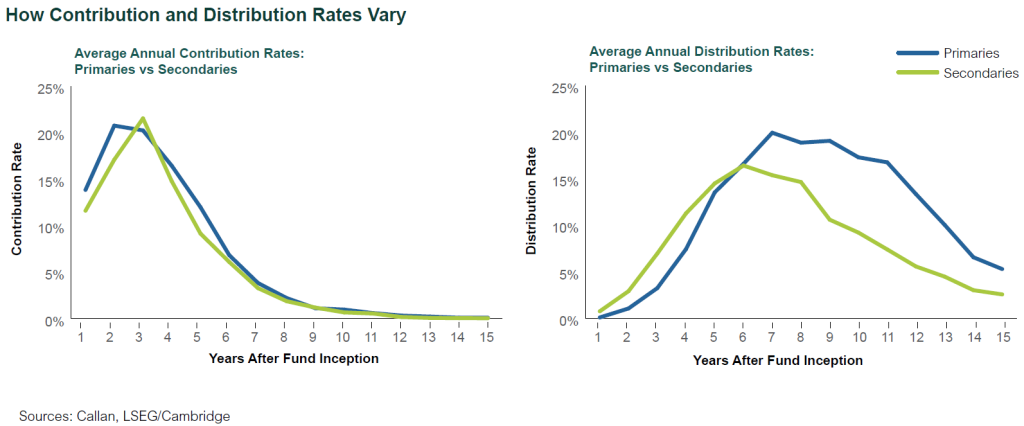

1) Capital Contributions and Distributions:

- Contribution rates are similar between the two.

- Secondary funds distribute capital faster than primary funds, leading to higher early-year liquidity.

- Primary funds eventually surpass secondary funds in total distributions over longer horizons.

2) Appreciation and the J-Curve Effect:

- Secondary funds experience early positive appreciation, whereas primary funds often begin with negative returns due to fees and initial underperformance.

- Primary funds tend to achieve higher long-term appreciation.

3) Net Asset Value (NAV) Development:

- Secondary funds reach a lower NAV peak (~65% of total commitment by year 4).

- Primary funds achieve a higher peak NAV (~95% of total commitment by years 5-6).

- This distinction affects how investors allocate commitments to maintain target NAV levels.

Performance Comparison: IRR and TVPI

Internal rate of return (IRR) and total value to paid-in capital (TVPI) metrics reveal key differences between primary and secondary funds.

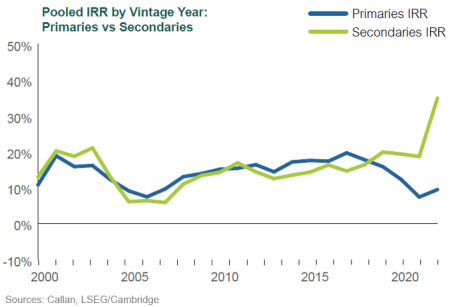

1) IRR Performance:

- Secondary funds and primary funds have generated similar IRR performance across vintage years, with secondary funds demonstrating stronger relative performance during times of economic stress, such as the Dot-Com Bubble and the COVID-19 pandemic.

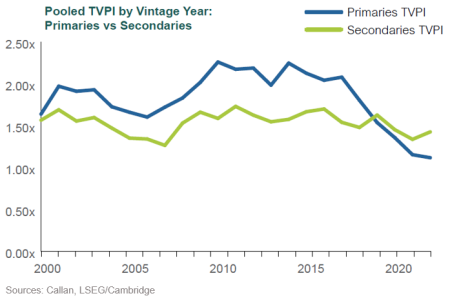

2) TVPI Performance:

- Primary funds consistently outperform secondary funds in TVPI, meaning they generate more total value, although secondaries outperform during more recent vintage years.

- The primary fund universe historically surpasses secondary funds by an average of 0.38x in pooled TVPI, according to data gathered by Callan from LSEG/Cambridge.

- Secondary funds tend to underperform in total value creation despite competitive IRRs.

3) Risk-Adjusted Performance:

- Secondary funds exhibit lower dispersion in returns, benefiting from diversified investment pools.

- Primary investments carry higher potential for strong performance but also higher variance.

Implementation in Private Equity Portfolios

Investors use secondary funds in different ways within private equity portfolios.

- Common Uses:

- Some use secondary funds selectively during portfolio funding stages for liquidity management.

- Others maintain a strategic allocation to secondaries.

- Portfolio Simulation Findings:

- A 100% secondary allocation outperforms in the short term but significantly underperforms over 20 years.

- The best long-term outcome comes from a 100% primary allocation, with a 1.65x TVPI and $91 million in positive net cash flow over 20 years, compared to 1.35x TVPI and $20 million for an all-secondary portfolio, using data calculated by Callan and sourced from LSEG/Cambridge.

- Mixed strategies (e.g., a 75/25 split) provide moderate short-term benefits but fail to improve long-term performance.

- Reasons to Use Secondary Strategies:

- A reduced risk profile: For investors that prioritize lower risk and shorter duration over maximizing returns

- Advantages during phases of portfolio funding: Quicker distributions and diversification in the early stages of a private equity program.

- Complementary exposure within a broader portfolio: Capitalizing on periods of economic volatility and acquiring portfolios at significant discounts when bid-ask spreads widen

- Lower implementation complexity: A less complex alternative to primary fund commitments

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.