Money market funds and stable value funds both serve as capital preservation vehicles in defined contribution (DC) plans. But the two differ substantially in how they are constructed, and those differences lead to varying outcomes for their returns depending on the interest rate environment. In this post we outline the key details of each type of fund and show how they have performed during the current inflationary period.

Both money market and stable value funds use book value accounting plus interest to achieve capital preservation. Both investment options also allow participants to transact daily.

Money market funds are mutual funds. They invest in very short-term debt and are required to have a weighted average maturity of 60 days or less; short-term rates serve as a yield ceiling. There are different types of money market funds. Those most appropriate for a 401(k) plan would be a government money market fund.

Stable Value Funds and DC Plans

Stable value funds are only available in qualified DC plans such as a 401(k) plan. They are offered as a collective investment trust (CIT) or a separate account. Stable value funds use insurance wrap contracts to allow participants to deposit or withdraw at book value, even in periods where interest rates have risen and fixed income market values have fallen below book value. The insurance contracts are there to protect against rising interest rates—not credit default risk. The insurance wrap contracts create counterparty risk, typically with insurance companies, and it’s a best practice to diversify this risk.

The stable value fund may require an “equity wash provision” when a money market fund is offered. The provision requires a participant to invest in a “non-competing” option, which explicitly excludes money market funds for 90 days when moving money out of a stable value fund. This prevents participants “gaming” short-term interest rate movements.

Stable value fund managers invest in a diversified portfolio of high-quality, intermediate duration fixed income securities. Participants earn a crediting rate, not to fall below 0%, which is typically reset quarterly.

- Market value gains or losses are amortized over the duration of the portfolio (e.g., 2-4 years)

- The crediting rate is based on the market value, book value, yield-to-maturity, and duration of the underlying assets.

Assets not covered by a wrap contract are usually held in short-term money market instruments.

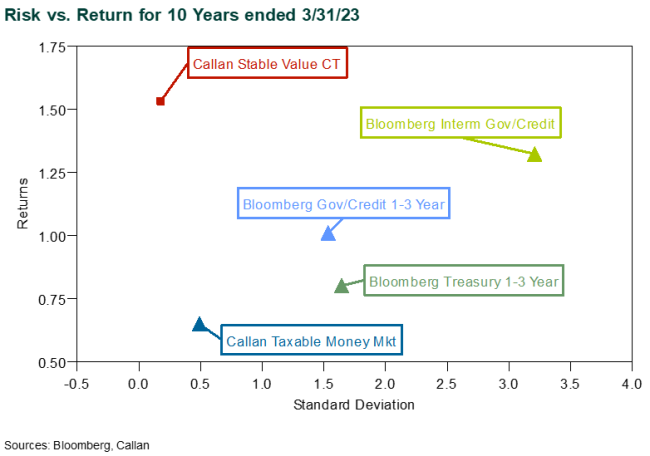

Stable value funds have exhibited returns in between the Bloomberg 1-3 year Government/Credit Index and Bloomberg Intermediate Government/Credit Index, and volatility similar to cash.

Current Interest Rate Environment

Crediting rates pivoted and began trending upward as the Fed began raising rates in 2022. Market-to-book ratios have decreased below 100%, which is expected during a rising rate environment.

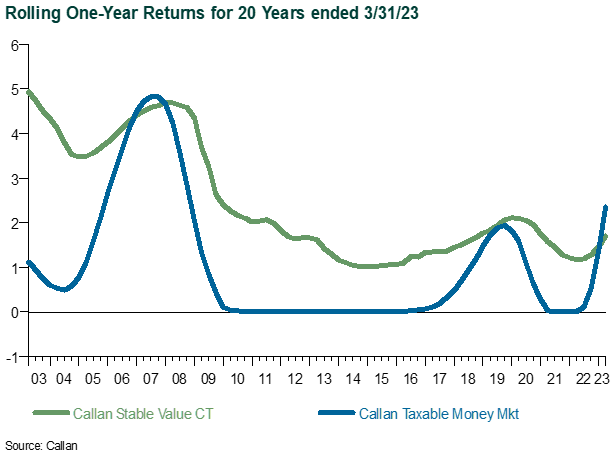

Stable value wrap contracts protect investors from the mark-to-market losses resulting from rising interest rates via the crediting rate mechanism, which amortizes the market value losses over the duration of the portfolio. Over time, the market-to-book ratio should return to “par” (100%). This return pattern is commonly referred to as stable value’s “smoothing” of returns.

Because of the differences in their fixed income structures, stable value funds tend to outperform money market funds over the long term. But in rapidly rising rate environments, such as 2022, money market funds tend to outperform because they are more responsive to the rise in rates, reinvesting the cash flows from maturing cash securities in the prevailing higher yielding securities.

It should be noted that stable value funds have done well compared to many of the low-volatility asset classes that investors look to for help preserving purchasing power, and in fact have outperformed money market funds since mid-2020 through much of 2022, when inflation began accelerating, although the results are mixed after that.

During an inverted yield curve environment, stable value funds can be challenged relative to money market funds, which reinvest the cash flows from maturing securities in prevailing higher yielding cash securities, thereby producing strong short-term gains relative to stable value. These periods have historically been brief; however, the pace of the recent hiking cycle is unprecedented and as a result money market funds may continue to outperform in the near-term. Longer term, stable value has shown that it can generate competitive returns by nature of its broader investable universe.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.