Only 50% of U.S. small cap growth managers outperformed the Russell 2000 Growth benchmark at the end of 1Q24. In comparison, 67% of small core managers and north of 75% of small value managers outperformed their comparable benchmarks. The dispersion in active management results between active small cap growth managers and their core and value counterparts can be strongly attributed to two culprits: Supermicro and Microstrategy.

Supermicro makes artificial intelligence (AI) infrastructure solutions; the stock’s fast and furious rise has been correlated with the increasing demand for AI, and to some degree with the continued dominance of Nvidia, one of the company’s most meaningful AI-related partnerships.

Microstrategy, on the other hand, is considered a bitcoin proxy; it is the largest corporate bitcoin holder, thus participating in the surge of cryptocurrency performance in 2023.

Big Surge for Supermicro and Microstrategy

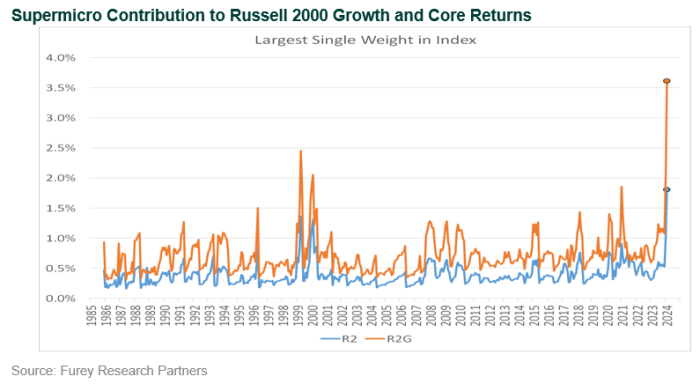

By the end of 2023, Supermicro stock was up over 250% while Microstrategy stock was up over 330%; the stocks’ strong performance has extended thus far into 2024. Due to their combined position sizes in the Russell 2000 Growth and Russell 2000 Indices (6% and 4%, respectively), the returns of both stocks have been incredibly impactful to benchmark performance. For instance, as of March 2024, Supermicro alone contributed over 300 basis points to the Russell 2000 Growth’s total return of 7.6%. The concentration, both from a holdings and performance standpoint, is something we do not often see in the small cap benchmarks.

Because of the position sizes and performance of Supermicro and Microstrategy, some managers with zero or underweight positions in these stocks have experienced some challenges with portfolio performance. Reasons cited by managers for zero or underweight exposures include:

- Implementation hurdles: The market capitalization for Supermicro has increased substantially in a short period of time. Prior to the 2023 Russell reconstitution, Supermicro’s market cap hovered around $5 billion, which is also the average market cap for a Russell 2000 company. Between April and June 2023, its market cap increased to $13 billion (and ended the year at $15 billion). YTD 2024, its market cap has jumped to $60 billion. The stock even earned a place in the S&P 500 Index in March 2024 (concurrent with its position within the small cap benchmarks). For small cap managers with buy-and-sell disciplines which prescribe that transactions take place within the small cap range (under $1 billion to $10 billion), the purchase of or incremental adds to Supermicro after the 2023 reconstitution would have violated these construction guidelines. Similarly, many that owned the stock were forced to sell the position entirely once it graduated beyond the small cap market cap range.

- Valuation: The precipitous rise in the stock prices for both companies led many managers to question the stocks’ respective risk/rewards and potential negative implications of participating at that stage in their life cycles.

- Fundamentals: Some long-only active managers remain mixed on bitcoin-related/cryptocurrency investments, given their speculative nature. As for Supermicro, some managers have expressed broad concerns, ranging from management quality to the persistence of growth beyond the ongoing AI hardware cycle.

Thankfully, for active small cap growth (and core) managers, Supermicro and Microstrategy have graduated out of small cap benchmarks with the 2024 Russell reconstitution. While their exits may alleviate the pressure that managers have experienced in navigating their positions, these stocks have been a good impetus for managers to re-engage on their approach to risk management, particularly when there are stocks that comprise a significant portion of the total portfolio’s risk budget. Given that, as we head into the second half of 2024, there are important considerations for institutional investors to assess as they continue to engage with their small cap managers:

- AI exposure and diversification of risk: Generally speaking, managers with exposure to the AI ecosystem, ranging from semiconductors to various AI-related themes within the Industrials sector (such as electrification and data centers) were able to mitigate some of the attribution challenges caused by underweight or zero exposure to Supermicro and Microstrategy combined. This suggests that AI is an important consideration from a portfolio construction and risk standpoint. If a manager’s view reflects a conservative view of AI and its value proposition going forward, it is worth asking how it will manage the active bet/risk of a contrary view should AI performance persist. Conversely, if a manager has a heavy active weight to AI as a theme, it also worth asking how holdings diversification, both within AI exposures and at the aggregate portfolio level, is maintained to ensure proper risk diversification within the portfolio.

- Performance: While Supermicro and Microstrategy have graduated out of the small cap benchmarks, there will inevitably be a performance overhang, especially for portfolios that lacked exposure to these names and AI in general. Akin to the suggested dialogue on AI exposure, discussions on portfolio positioning and how it will iterate over time may be useful, particularly if today’s AI-heavy market backdrop persists.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.